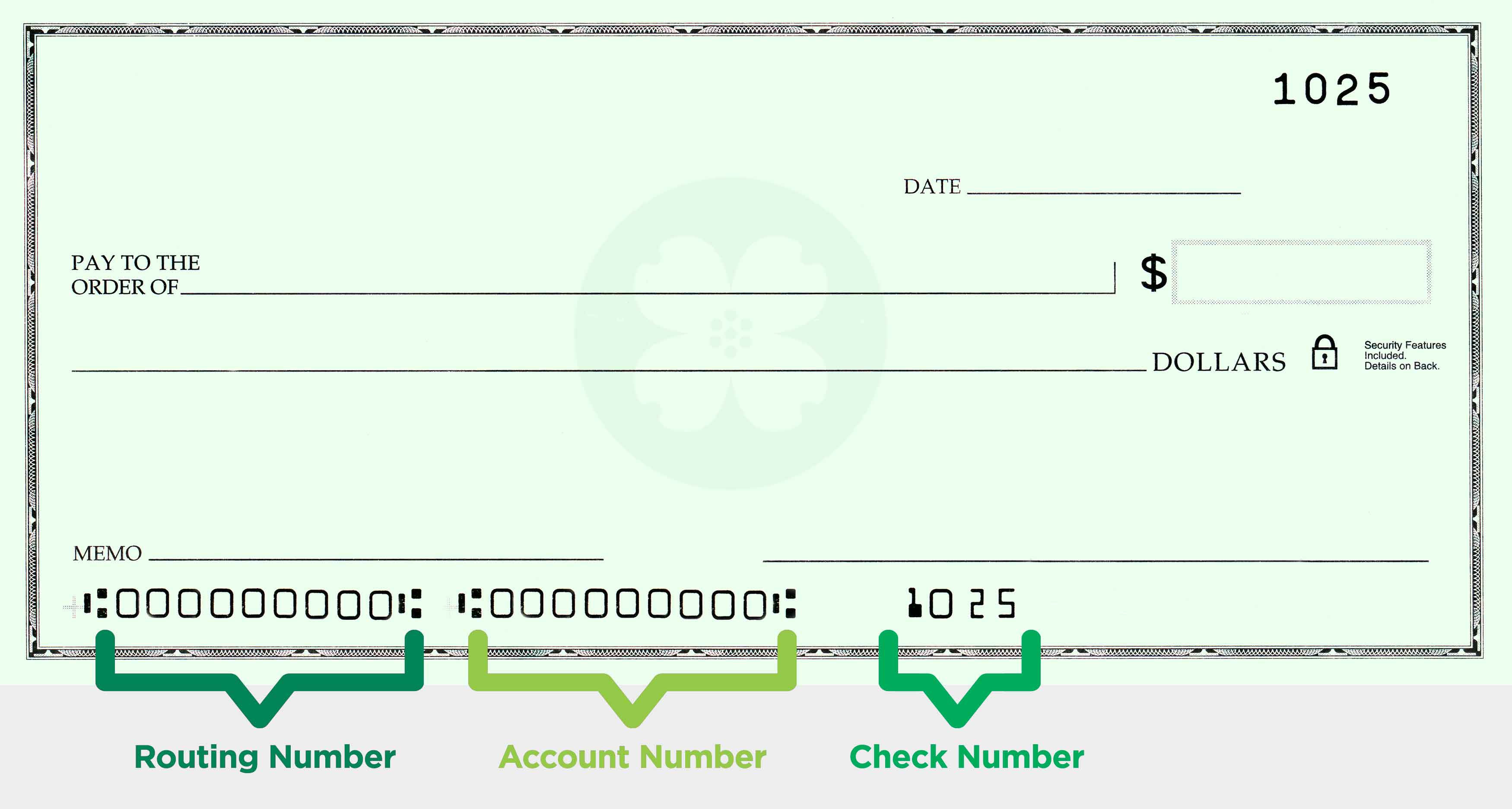

Each bank and financial institution has a specific nine-digit routing number that is used to identify it. You can find your bank’s specific routing number with the first 9 digits on the bottom left corner of your check.

Here is a complete listing of all Central Bank’s routing numbers.

Each CD that is opened at Central Bank has a specific rate determined by the date, term length, and CD deposit amount. For this reason, we are unable to publish our CD rates because they are always changing. Contact your local branch to ask us about today’s CD rates.

With a minimum of $2,500, you may open a 13 or 25 month CD online.

Central Bank offers fixed and adjustable-rate home loans. To get an estimated rate based on your purchase price and down payment, visit one of our home loan lenders page and select Today’s Rates.

To order checks for your Central Bank Checking Account, log in to Online Banking. Under the “Additional Services” heading, select “Order Checks.” You will be taken to Harland Clarke, the vendor that handles our check re-orders, where you can choose from multiple check designs. You will need the following information to complete your order:

Health Savings Accounts (HSAs) give you another option for managing the high costs of healthcare. With HSAs, you have more control over your money. You can invest money for current and future medical expenses and grow it tax-free (consult your tax advisor for details). Unlike flexible spending accounts, which are controlled by employers and have a use-it-or-lose-it limitation, HSAs are portable and belong to the consumer for life.

Open an HSA >> Learn More about an HSA >>

An overdraft occurs when you don’t have enough money in your account to cover a transaction, but we pay it anyway. Whenever this occurs, an overdraft fee is typically assessed to your account. Alternatively, if there are insufficient funds in your account, we may return a transaction back to the sender and may assess a return check charge (NSF).

As a courtesy, your account may be covered with overdraft access. With this service, we pay overdrafts for checks and other transactions made using your checking account number. (Transactions are processed up to an amount that may vary as displayed on your monthly statement. Overdraft fees will still apply).

We do not pay overdrafts for ATM transactions or everyday debit card transactions unless you ask us to. If you want these types of transactions, log in to your Online Banking account, under Card Management, select Overdraft Enrollment.

Please refer to the document “Understanding Your Deposit Account” that you received at account opening for more information about our Overdraft Access Policy.

Simply log in to Online Banking and select Change PIN under Card Management. If you have an EMV chip card and plan on travelling internationally, you will need to use an EMV enabled terminal or ATM prior to your travel to sync the PIN with the chip in your card to reduce potential issues.

To turn off your card so it can’t be used for new purchases, please call the phone number that is listed on the back of the card.