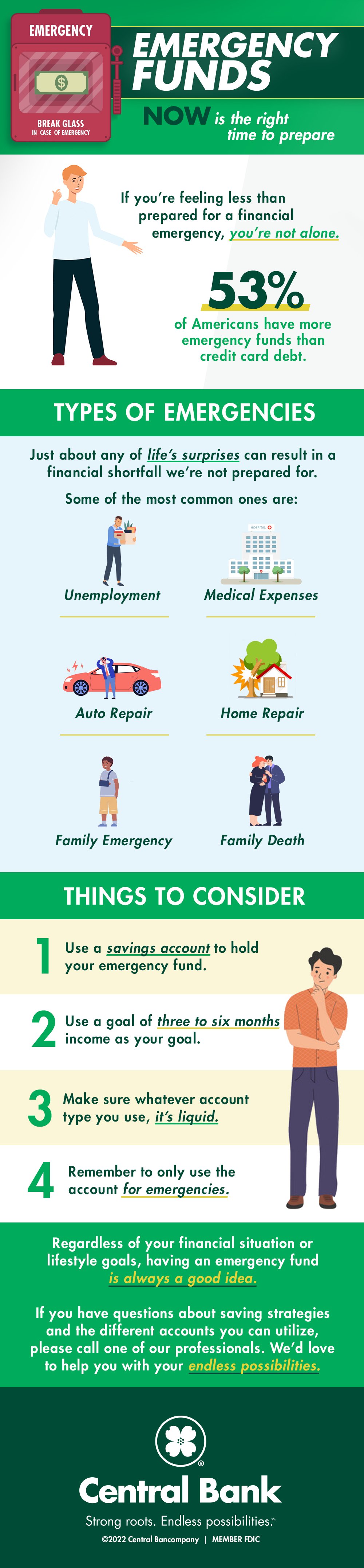

If you’re feeling less than prepared for a financial emergency, you’re not alone. According to Bankrate, just over half of Americans (53%) have more emergency funds than credit card debt.

If you currently have between three and six months’ worth of income in a liquid account which you can access in an emergency, you are in the minority and in a good position to lower financial stress in such a situation.

What types of emergencies do I need to prepare for?

Just about any of life’s surprises can result in a financial shortfall we’re not prepared for. Some of the most common ones:

- Unemployment

- Medical Expenses

- Property Damage/Home Repairs

- Auto Repairs

- Family Emergencies

- Death in the Family

‘Tis the season

You don’t have to wait for a New Year’s Resolution to start your emergency fund. Any time is a good time to get started, or to commit to putting more aside than you currently do. And with the holidays nearing and stockings to stuff, there’s no better time than now to stuff your emergency fund.

Important things to consider:

- Use a savings account to hold your emergency fund.

- Use a goal of three to six months of income as your goal.

- Make sure whatever account type you use, it’s liquid. In other words, you can access the money quickly and without penalty.

- Remember to only use the account for emergencies.

One easy method for saving to consider is to open a bank account that has a “round up” feature. You can automatically round up purchases from your checking to savings account with every debit card transaction.

Regardless of your financial situation or lifestyle goals, having an emergency fund is always a good idea. And while you may be one of the lucky few that doesn’t run into a financial emergency, knowing you have the funds available to cover sudden shortfalls can give you much welcomed peace-of-mind.

If you have questions about saving strategies and the different accounts you can utilize, please call one of our professionals. We’d love to help you with your endless possibilities.