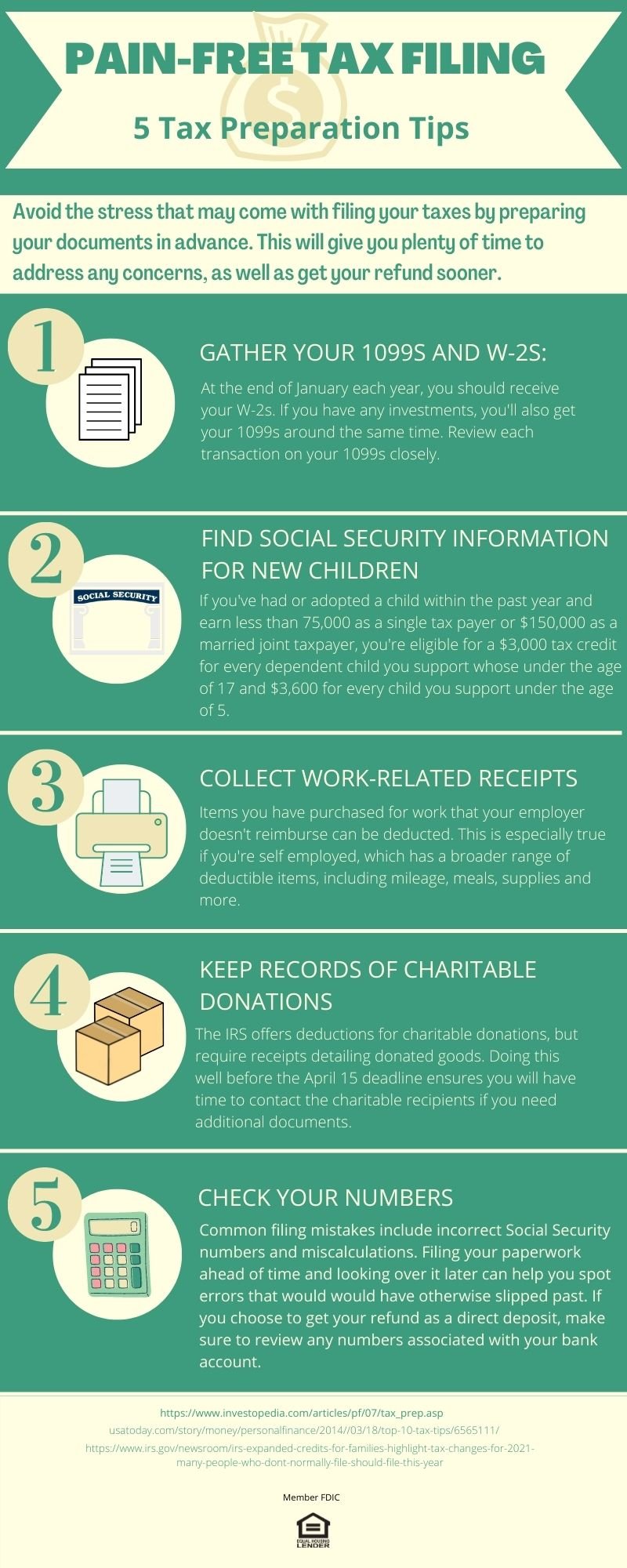

With tax season rapidly approaching, April 15 never seems far off. Many Americans rush to get all their financial information and documentation together. It can be a challenging process, but the earlier you have your fiscal documentation in order, the easier it is to file taxes and avoid any potential problems. Prepping early in the year also gives you more time to review your paperwork and avoid errors that might have been missed.

Here are a few additional tips to consider when filing your taxes:

Gather your 1099s and W-2s

Normally, you will receive your W-2 forms from your employer at the end of January. If you have investments, you will receive your 1099s, which detail any stock or bond transactions from the previous year, around the same time.

Know your children's information

If you've had or adopted a child in the last year, you may be eligible for a tax deduction. According to the IRS, adopters who earn less than $75,000 per year as a single taxpayer or $150,000 as married joint taxpayers are eligible for a $3,000 tax credit for every dependent child supported from age 6-17. For dependent children ages 5 and under, taxpayers are eligible for $3,600.

Keep your records together

If you've made purchases for work that weren't reimbursed by your employer, you may be able to deduct those costs on your tax return. This is especially true for self-employed workers who might be able to deduct meals, mileage, supplies, and other items.

Charitable donations are also important to keep track of. The IRS offers tax deductions for donated goods, but requires detailed receipts of such transactions. For those who have donated, it’s a good idea to collect charitable receipts as soon as possible to avoid problems with the April 15 tax deadline. Depending on the charity, it could be timely for the organization to provide you with those receipts.

Double check yourself

Lastly, once you are done filing, double check your numbers. Common filing mistakes include incorrect social security numbers and miscalculations. Give yourself enough time and file early so you can look over it and make corrections. If you choose to get your refund as a direct deposit, make sure to review any numbers associated with your bank account.

*Consult your professional tax advisor for details