It is no secret that Americans are increasingly burdened by student loan debt. It is imperative for students to understand the responsibility they are undertaking when accepting student loans. If the responsibility of paying off student loans is not taken seriously, increased financial difficulties are imminent. The penalties for defaulting on loan payments include added fees, added interest, and wage garnishment.

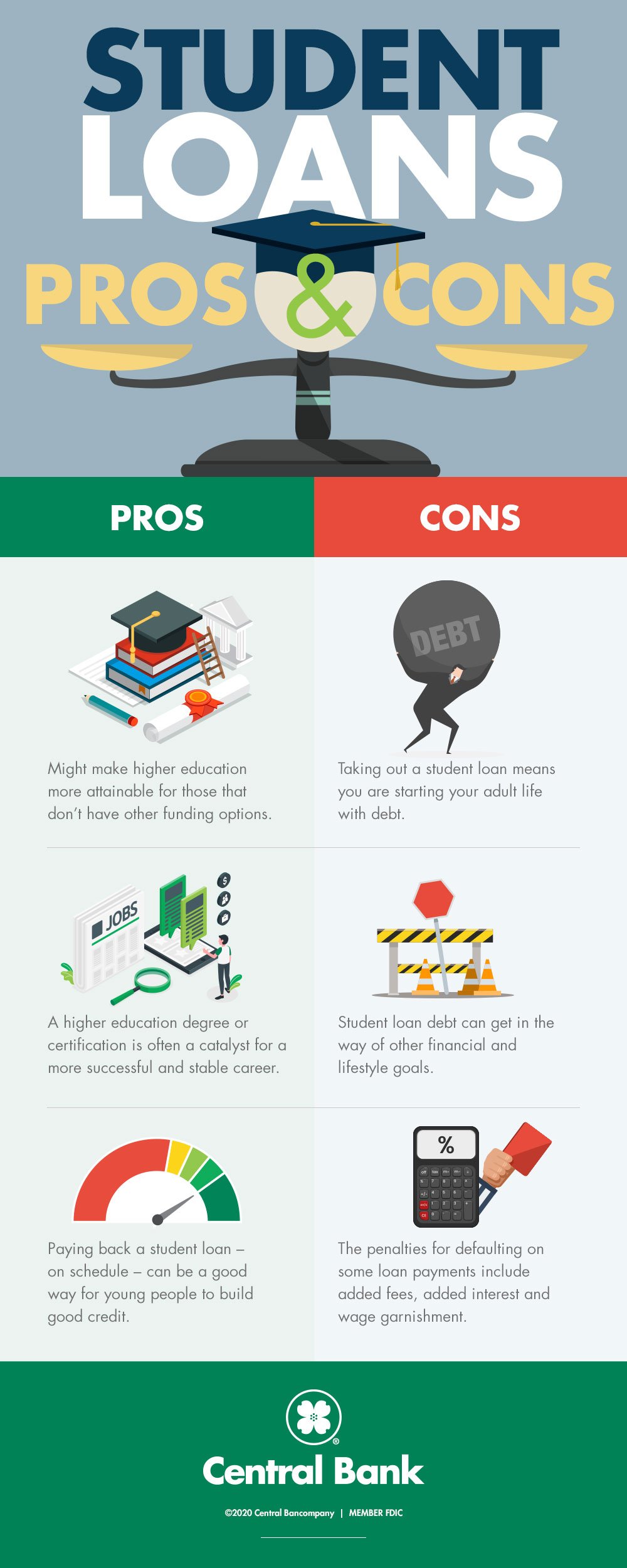

What are the Pros?

- They might make higher education more attainable for those that don’t have other funding options

- A higher education degree or certification is often a catalyst for a more successful and stable career.

- Paying back a student loan - on schedule - can be a good way for young people to build good credit

What are the Cons?

- Taking out a student loan means you are starting your adult life with debt.

- Student loan debt can get in the way of other financial and lifestyle goals.

- The penalties for defaulting on some loan payments include added fees, added interest and wage garnishment.

Certainly, student loans can be a blessing for many people, as not everyone has the luxury to afford college. Be it lifting people out of poverty, or helping struggling Americans make ends meet, a source of credit for those unable can have immeasurable benefits. It also is a chance for students to start laying the foundation of their credit history by staying on top of their payments. However, it is important for students and families know the risk and burden they are taking on.

When an individual takes out a student loan, they are essentially betting that they will come out of their college career with the human capital to repay their loan in principle, plus interest. But an education that allows a student to have a fulfilling career and life is worth the financial stress taking out student loans incurs.