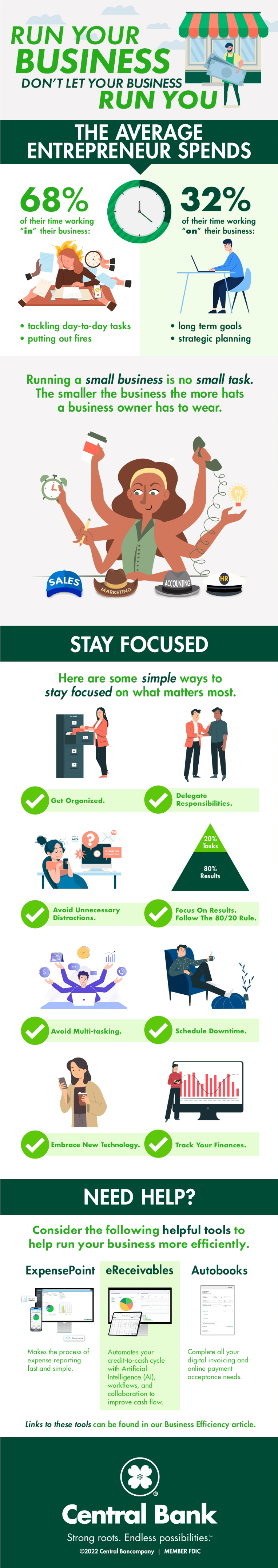

The average entrepreneur spends 68.1% of the time working “in” their business—tackling day-to-day tasks, putting out fires, etc. —and only 31.9% of the time working “on” their business—i.e. long-term goals, strategic planning—according to research from The Alternative Board (TAB).

Running a small business is no small task. In fact, the smaller the business, all the more hats a business owner has to wear to keep the company moving in the right direction.

As responsibilities pile up over time, how does one continue to do the critical things a leader should be focusing on – company vision, strategy, culture, staying ahead of market demand, regulations, sales, client relations, and much more?

Here are some simple ways to make most of your diminishing time and stay focused on what matters most:

- Get Organized. Organize your workspace and organize your work

- Delegate Responsibilities. Decide what tasks to offload and identify the right person(s) to take on those responsibilities.

- Avoid Unnecessary Distractions. Turn your phone off more frequently, and be more “present” during work hours.

- Follow the 80/20 Rule. Focus your time and energy on the 20% of tasks that get you 80% of the results.

- Avoid Multi-tasking. Concentrate on one thing at a time and organize your day that way.

- Schedule Downtime. Time off helps you re-energize and think more clearly and creatively.

- Leverage Technology Tools. Embrace apps that are designed to help you take charge of your schedule and workflow

- Track Your Finances. Implementing an online accounting system early on will help you stay organized, which will save you time later.

Need Help?

Consider the following helpful tools that range from credit card expense reporting to integrated receivables and digital invoicing and payment acceptance.

- ExpensePoint: Makes the process of expense reporting for your Central Bank Business Mastercard® or Commercial Mastercard Multi Card® fast and simple.

- eReceivables: This is an integrated receivables product which automates your credit-to-cash cycle with Artificial Intelligence (AI), workflows, and collaboration to improve cash flow.

- Autobooks: Easily complete all your digital invoicing and online payment acceptance needs.