At the bank, we are diligent about security and are constantly making small to significant investments in our security protocols and systems. However, we can only help protect you to an extent. If you've experienced any sort of fraud, you are probably aware of the damage and headaches associated with identity theft. If you haven't, consider yourself lucky and remember it is important to be aware of potential fraud in the digital world.

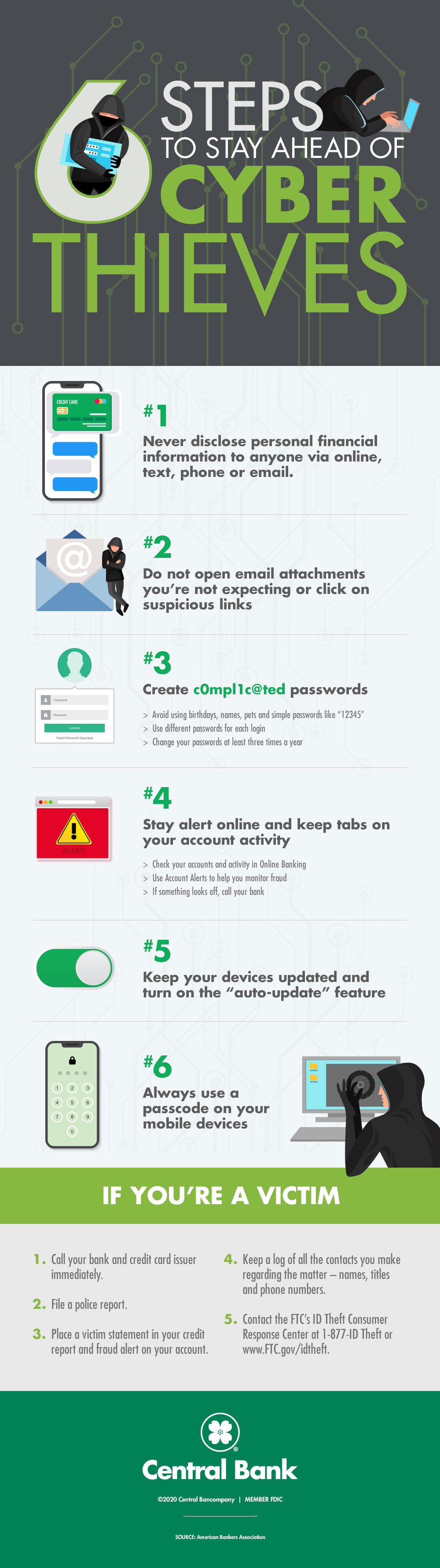

- Never disclose personal financial information to ANYONE - online, text, phone, or email. Unless you are in a bank or call our customer service center, we will not ask you for any personally identifiable information.

- Do not open email attachments you are not expecting, or click on suspicious links from a sender you may or may not trust. If you find yourself interested in an email solicitation and it seems questionable, simply type the URL in the address bar instead of clicking on the link provided in the email.

- Create complicated passwords and avoid using traits someone could easily find out if they did a little research. Avoid using birthdays, your name, pet names, phone numbers, and simple passwords like “12345” or “password.” Also keep in mind you should use different passwords for each login, changing your passwords at least three times a year.

- Stay alert online and keep tabs on your accounts. It is very important you enter the online world with a suspicious attitude keeping your security and privacy on the top of your mind, especially if you are looking to purchase goods or services. If your account has suspicious activity, do not hesitate to report it to the bank. The quicker you act the better chance you have at mitigating potential theft. When you're not online, always disconnect from the internet.

- Keep anti-virus software up-to-date. These programs need frequent updates to guard against potential new viruses. Some anti-virus programs offer an “auto-update” feature, where regular updates could be made for you behind the scenes.

- Mobilize your defenses by using the passcode lock on your smartphone and other mobile devices. This will make it difficult for thieves to access your information if it is lost or stolen.

What to do if you suspect your personal information has been compromised:

If your phone or tablet is lost or stolen, disable it immediately. Contact your cell phone provider if you need assistance. Always use the password function on your phone to heighten security in the event it is lost or stolen.

If you believe you have received a suspicious email, phone call or text message asking for information about your financial accounts, report it to your bank immediately.

In the event you've accidentally or unknowingly disclosed sensitive information to a cyber thief, contact the three national credit-reporting organizations and the Federal Trade Commission immediately to place a fraud alert on your name and identity. This will help prevent thieves from opening a new account in your name.

Here is the contact information for each bureau's fraud division:

Equifax

(800) 525-6285

P.O. Box 740250

Atlanta, GA 30374

Experian

(888) 397-3742

P.O. Box 1017

Allen, TX 75013

TransUnion

(800) 680-7289

P.O. Box 6790

Fullerton, CA 92634

Report all suspicious contacts to the Federal Trade Commission at www.identitytheft.gov, or by calling (877) IDTHEFT (877) 438-4338)

Don't forget to file a police report. An official report will help authorities bring criminals to justice and will help authorities gain insight on how the crime was committed.

In addition, federal law allows you one free copy of your credit report each year from the three primary agencies without harming your credit score. To obtain your free report, visit www.annualcreditreport.com. You should review your credit report regularly to monitor potential fraud.

We are here to help you. If you think you are a victim of fraud, take action immediately. We take your security very seriously and will help investigate immediately.