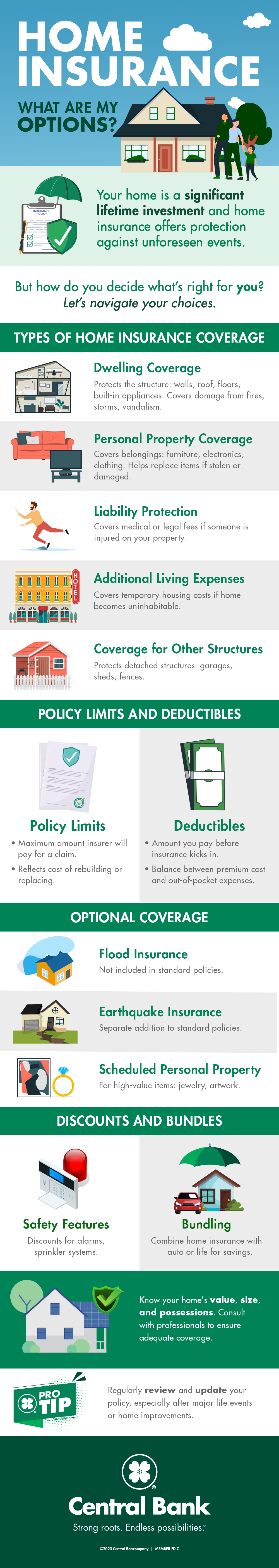

Owning a home is one of the most significant investments you make in your lifetime. It is crucial this investment is protected against unforeseen events, from natural disasters to thefts. Home insurance offers a layer of protection. But with various coverage options and terms floating around, how do you decide what's right for you? Let’s break down the essential aspects of home insurance to help you navigate your choices.

Types of Home Insurance Coverage

- Dwelling Coverage: This is the foundational coverage for most home insurance policies. It protects the structure of your home – walls, roof, floors, and built-in appliances – against damage from events like fires, storms, or vandalism.

- Personal Property Coverage: This protects your belongings inside the house, such as furniture, electronics, and clothing. If these items are stolen or damaged, this coverage helps replace them.

- Liability Protection: If someone gets injured on your property and you're deemed responsible, this coverage help cover medical expenses or legal fees.

- Additional Living Expenses: If a covered event makes your home uninhabitable, this helps cover the costs of temporary housing and other related expenses.

- Coverage for Other Structures: This covers structures not attached to your main house, such as garages, sheds, or fences.

Policy Limits and Deductibles

- Policy Limits: This is the maximum amount an insurance company will pay toward a covered claim. Ensure your limits reflect the cost of rebuilding or replacing your property.

- Deductibles: The deductible is the amount you'll pay out of pocket before the insurance kicks in. A higher deductible usually means a lower premium, but it also means paying more when you file a claim.

Optional Coverage

- Flood Insurance: Standard home insurance doesn't cover flood damage. If you live in a flood-prone area, you might consider this.

- Earthquake Insurance: Similarly, earthquake damage is not covered in most standard policies, but can be added separately.

- Scheduled Personal Property: For high-value items like jewelry or artwork, you can insure them separately for more comprehensive coverage.

Discounts and Bundles

- Many insurers offer discounts for safety features like alarms or sprinkler systems. Additionally, bundling your home insurance with auto or life insurance can lead to significant savings.

To make the right decisions regarding home insurance, it’s essential to understand the basics and your options. Familiarize yourself with your home, including it’s size, makeup, value, worth of your possessions and general cost to rebuild.

Consult with your insurance professional to make sure you're adequately covered.