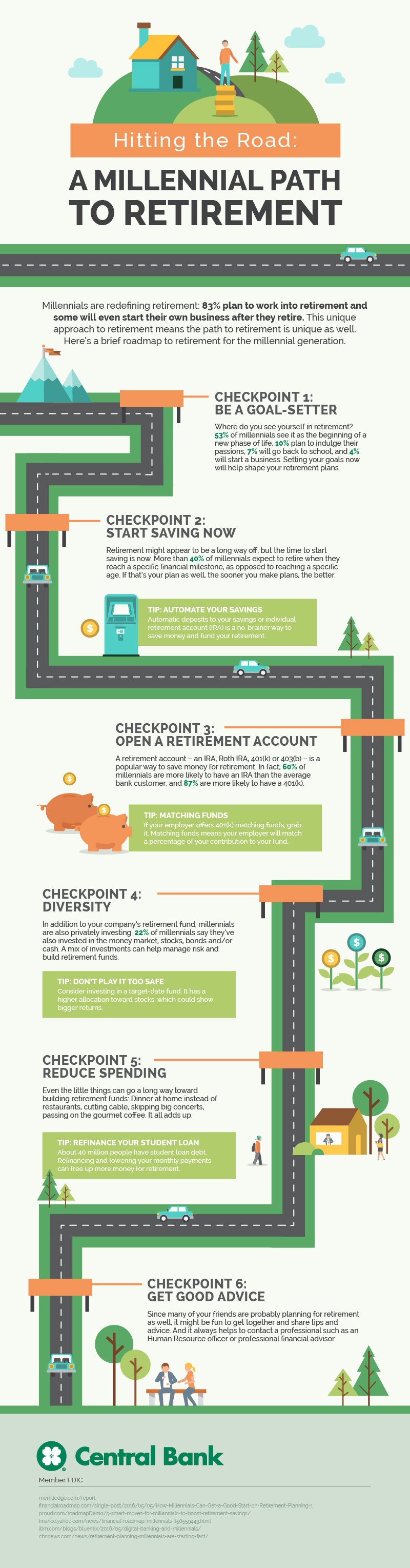

But the truth is, the time to start saving for retirement is now. Time moves quicker than you might think, and you'll always have an excuse to not put away money: a new car, student loans, or a new house. “The less you save now, the more you have to save later” may be an obvious statement; however, recent graduates tend to disregard it. We understand it can be hard to get motivated to start saving, so here are six tips to get you in the retirement saving mindset!

1. Be a goal-setter. Set and track your goals with a clear timeframe in mind. According to CBS News, almost two-thirds (65 percent) of millennials said they'll work to age 65 or later, and half report that they plan to work in their retirement years. [1] So, setting that goal of a specific retirement age will determine ultimately how much you need to start saving. Check out our retirement calculator for a starting point.

2. Start saving NOW. It may feel like you have plenty of time before you need to start saving for retirement; however, the sooner you start saving, the better. The difference between totals saved in your paycheck starting at age 25, versus 35 is stunning. Do not wait until your 35 to start saving for retirement.

3. Open a retirement account. Opening a retirement account can sound intimidating; it's money that will not be available to you, even in case of an emergency. According to CBS News, almost three-fourths (72 percent) of millennial survey respondents said they're saving for retirement in an employer-sponsored retirement plan or outside of work. The median amount they're saving is 7 percent of their annual salaries. [1] The reality of saving for retirement isn't as scary as it sounds and by putting your contributions on autopilot, your funds will add up quickly. Especially if your employer offers a contribution matching program for your 401(k).

4. Diversify. “Don't put all your eggs in one basket” holds true to the world of finance and retirement savings. As you save for your golden years, be sure to spread your savings across several mediums. For example, consider investing in a low risk option such as a mutual fund.

5. Reduce spending. By cutting back on extra expenses like entertainment and eating out, you can make an impact on the amount you save. This will allow you to put that change away for retirement. Capitalizing use on your rainy-day fund instead will give cause for thanks later. You can utilize online tools, such as Money Manager, to keep a close eye on your saving.

6. Phone a friend. Knowing when and how to retire can be hard to determine. Consulting a Central Investment Advisors can help determine retirement goals that fit you. Central Bank's Investment Advisors will review your current economic situation to set up a retirement plan that fits your budget, so that you're saving at a pace that is comfortable to you!

Life flashes before your eyes and the next time you blink it'll be time for retirement. Don't be caught unaware. Start saving now so you can enjoy later.

Source:

[1] Retirement planning: Millennials are starting fast, CBS News