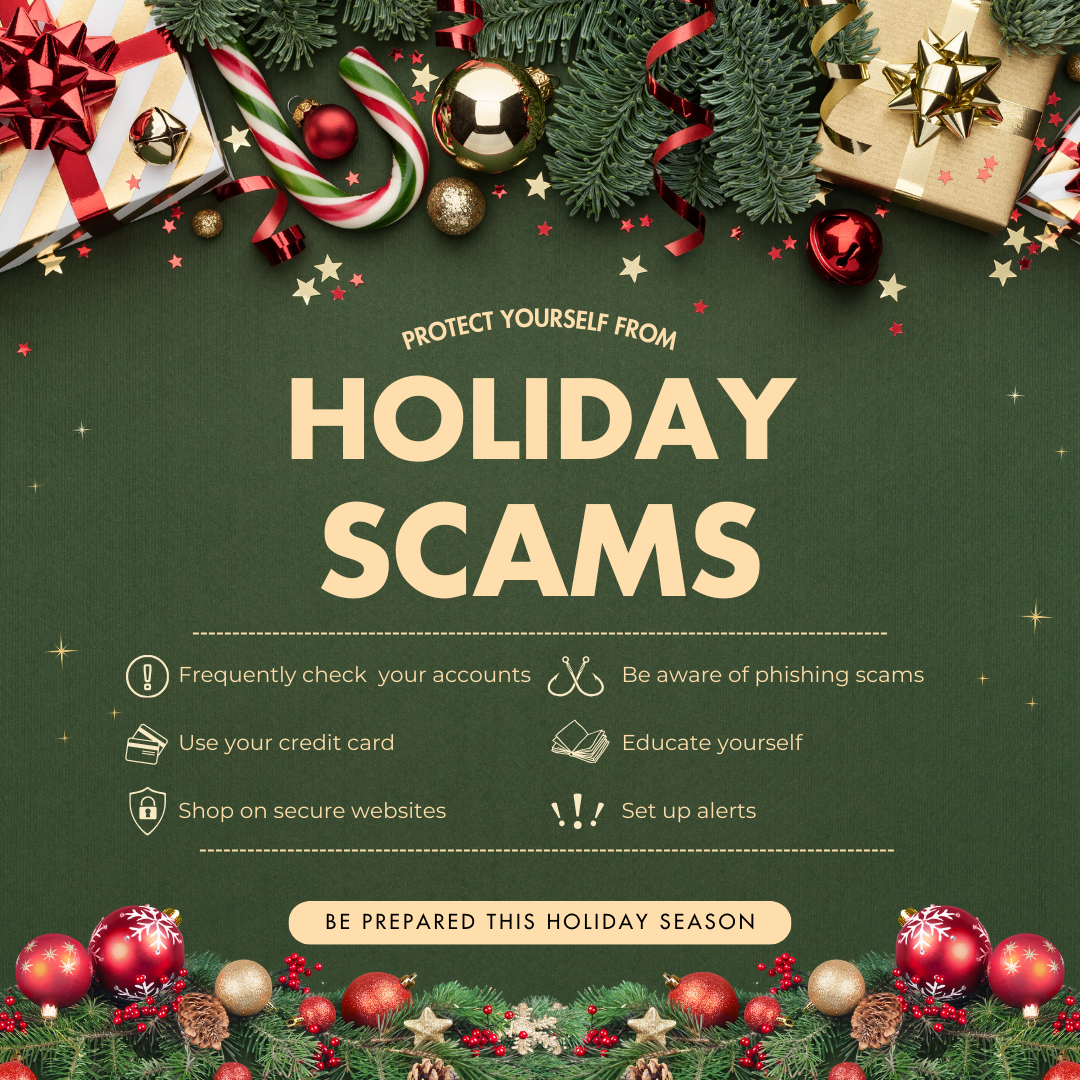

It’s the holiday season, and people are busy shopping and giving gifts. Using credit cards is smart, although the holidays are a prime time for fraudsters. People get caught up in the joy of the holiday season and sometimes forget to comb through bills, emails, and identify scams. With these simple tips you can protect yourself from fraud during the holidays.

Frequently check on your accounts

By looking through your bills and active charges you can take measures to ensure the safety of your credit card. If you see something suspicious, you can immediately lock your card and report the abnormal activity.

Shop with your credit card

The money you spend on your credit card is a loan from the bank that you pay back every month. While the money on your debit card is your own. If you encounter fraud it is better to have it on your credit card versus your debit card as your money is more protected.

Shop on secure websites

When shopping for your gifts and decorations, make sure the website you're using is legitimate. Prioritize websites that have a secure connection and a URL with “https://”. Avoid making purchases on unfamiliar or unsecure websites.

Be aware of phishing scams

Phishing scams become more frequent during the holidays. Fraudsters use festive themed emails, messages, and social media posts. Avoid clicking on suspicious links or links from people you do not know.

Educate yourself on common scams

If you educate yourself on common holiday scams you can better protect yourself from them. Common scams include: fake charity requests, fraudulent travel deals, or deceptive online advertisements for sales. Being aware of common scams allows you to avoid potential threats that can ruin your holiday season.

Set up alerts

With alerts, you will receive a notification every time your card is used. This way, if you are subject to fraud or scams you can alert your bank right away once you get a suspicious notification. You can turn on alerts through your online banking. There are several alerts you can choose from like spend, transaction, and location alerts.

By being prepared, educated, and informed you can help protect your finances this holiday season from scams.