Typically, as your retirement date approaches, your saving and investment strategy adjusts. Moving retirement assets into less volatile investment vehicles becomes a common, and probably wise, decision.

The reason for moving funds into more secure investments is simple. If you kept your funds in more volatile investments, you won’t have as much time as an earner to make up for any losses you might incur.

So while you may have developed an investment strategy that is sound for a majority of your earning years, it’s smart to start looking at more conservative, or even fixed, investments as part of your asset allocation.

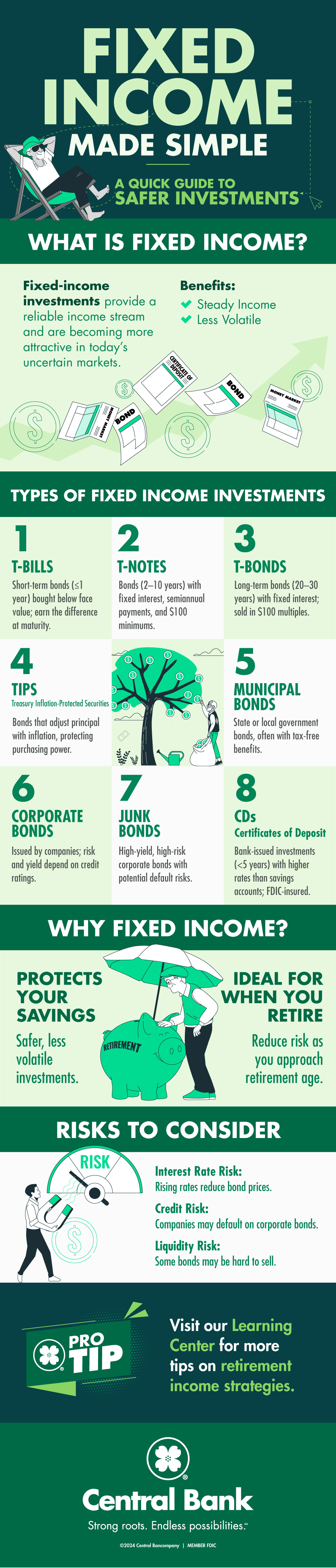

What is Fixed Income?

The most common forms of fixed income investments are bonds, money-market funds and certificates of deposits. These are investment vehicles that fit into a lower risk strategy, especially common as investors get closer to retirement age. These investments often focus on generating consistent payments to the investor.

Types of Fixed-Income Investments

- Treasury bills (T-bills) are short-term fixed-income securities that mature within one year and that do not make coupon payments. Investors buy the bill at a price less than its face value and earn that difference at maturity.

- Treasury notes (T-notes) have maturities between two and 10 years, pay a fixed interest rate, and are sold in multiples of $100. Throughout the note's term, investors receive semiannual interest payments. At maturity, they repay the principal.

- Treasury bonds (T-bonds) function similarly to the T-note except that they mature in 20 or 30 years. Treasury bonds can be purchased in multiples of $100.

- Treasury Inflation-Protected Securities (TIPS) protect investors from inflation. The principal amount of a TIPS bond adjusts with inflation and deflation.

- A municipal bond is similar to a Treasury as it is government-issued, but it is issued and backed by a state, municipality, or county, instead of the federal government. It is issued to raise capital to finance local expenditures. Muni bonds can offer tax-free benefits to investors, as well.

- Corporate bonds come in various types, and the price and interest rate offered largely depend on the company’s financial stability and creditworthiness. Bonds with higher credit ratings typically pay lower coupon rates.

- Junk bonds—also called high-yield bonds—are corporate issues that pay a greater coupon due to a higher risk of default. Default occurs when a company fails to pay the principal and interest on a bond or debt security.

- A certificate of deposit (CD) is a fixed-income vehicle with maturities of less than five years offered by financial institutions. The rate is higher than a typical saving account, and CDs carry FDIC or National Credit Union Administration (NCUA) protection.

Benefits of Fixed Income

- Fixed-income investments typically provide steady income, which is important for retirees or those close to retirement.

- Another primary reason is diversification. The goal of diversification is to lower the volatility of your portfolio’s performance by spreading the risk. This can be accomplished through stocks alone, but fixed-income investments usually provide even more stability.

The value of bonds typically rises and falls opposite to stocks, partly because investors see bonds as a safer place to put funds during volatile periods. For example, if the stock portion of your portfolio is down 10% but the bond portion is up 4% (and your portfolio is 50% bonds and 50% stocks), your overall losses are only 6%.

Are there risks with fixed-income securities?

While fixed-income assets are generally less risky than investing in growth-oriented investments like stocks, the approach is not risk free.

Diversification can be a good way to minimize many of the risks inherent in fixed income investing. This can be accomplished by looking at the following bond variables in choosing your bond strategy:

- Issuers, including the federal or a state government, or corporations

- Duration, or sensitivity to changes in interest rates

- Credit quality and yield, because high-quality bonds pay lower interest, while riskier bonds often pay more

- Tax treatment, which can vary depending on the issuer

Types of risks

- Interest rate risk. Investors don't have to buy bonds directly from the issuer and hold them until maturity. Instead, bonds can be bought from and sold to other investors on what's called the secondary market. Bond prices on the secondary market can be higher or lower than the face value of the bond.

- Credit risk. Bonds carry the risk of default, which means that the issuer may be unable or unwilling to make further income and/or principal payments. In addition, bonds carry the risk of being downgraded by the rating agencies which could have implications on price.

- Inflation risk. Inflation risk is a particular concern for investors who are planning to live off their bond income, though it's a factor everyone should consider. The risk is that inflation will rise, thereby lowering the purchasing power of your income.

- Call risk. A callable bond has a provision that allows the issuer to call, or repay, the bond early. If interest rates drop low enough, the bond's issuer can save money by repaying its callable bonds and issuing new bonds at lower interest rates. If this happens, the bondholder's interest payments cease, and they receive their principal early.

- Prepayment risk. Some classes of individual bonds, including mortgage-backed bonds, are subject to prepayment risk. Similar to call risk, prepayment risk is the risk that the issuer of a security will repay principal prior to the bond’s maturity date, thereby changing the expected payment schedule of the bonds.

- Liquidity risk. Liquidity risk is the risk that you might not be able to buy or sell investments quickly for a price that is close to the true underlying value of the asset.

Who Should Invest in Fixed Income Investments?

Fixed income investments are ideal for individuals looking for the safest tools to invest as well as individuals wanting a regular income payment.

- People who are wary of stock market fluctuations and looking for stable investments to spend their hard-earned money should strongly consider fixed income securities.

- Retired or close-to-retirement investors can also choose such securities while looking for alternative sources of investing. Most types of fixed income securities fulfill their essential requirement criteria of low risk and stable returns.

- Other investors looking to earn secure returns, as well as aiming to diversify his/her portfolio. Such schemes ensure a person has a stable flow of dividend during market downswing when other assets of substantially higher values do not yield adequate returns.

While fixed-income assets are generally less risky than investing in growth-oriented investments like stocks, the approach is not risk free. Moreover, investing in fixed income securities might reduce the real value of the money invested, as no adjustments are made against the inflation.

The key drivers to your decision making are where fixed income fits into your overall financial picture; and when you expect to use it.

In general, advisors typically recommend allocating toward fixed-income investments as retirement approaches. Doing so will reduce the risk of market-based turmoil taking an oversized bite from your portfolio at a bad time.

A balanced portfolio is often important to a sound retirement investment strategy. Fixed income is essential for a balanced portfolio. Becoming educated in this area can help you make better decisions.