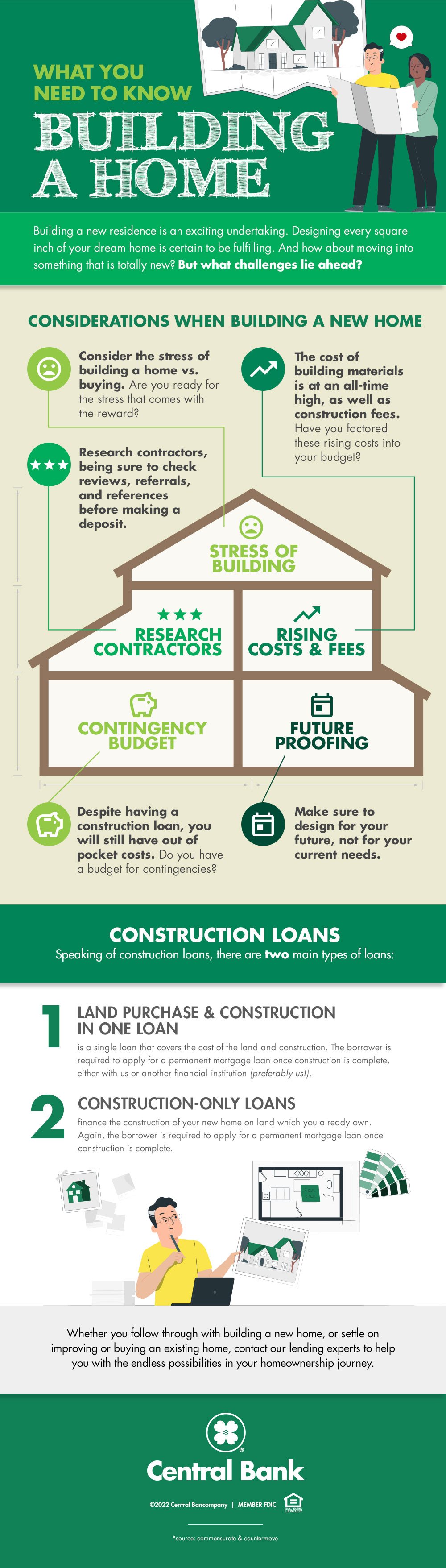

Building a new home is an exciting endeavor! Your home is where you bond with your family and relax after a long day’s work, which is why it’s important for you to have an ideal space that suits all your needs. Before you continue with your exciting home plans, here are a few things to consider when building a new home.

-

Research Contractors

Research contractors and be sure to check reviews, referrals and references before making a deposit. It is crucial to hire the right contractor or you may face poor workmanship, costly repairs, and extended delays to finish your home. -

Rising Costs and Fees

The cost of building materials is at an all-time high, as well as construction fees. Although the prices are rising, keep in mind the durability of your home and make sure you are using the right materials and not the cheapest. Your home should be able to last for decades, be sturdy and well constructed. Make sure you have factored these rising costs into your budget. -

Stress

Consider the stress of building a home versus buying. When building a home, you need to be prepared for the stress that comes with it. You may run into problems, such as spending more money than you originally planned due to inaccurate project estimates, design errors, poor site management, or not hiring the right people. Are you ready for the stress that comes with the reward? -

Budget

Despite having a construction loan, you will still have out of pocket costs. Do you have a budget for contingencies? It may be a good idea to create a checklist of your wants and needs if you are working with a limited budget. This way, you can figure out your priorities and move items to your wishlist to purchase later.

Speaking of Construction Loans, there are two main types of loans:

1. Land Purchase & Construction In One Loan is a single loan that covers the cost of the land and construction. The borrower is required to apply for a permanent mortgage loan once construction is complete, either with us or another financial institution (preferably us!).

2. Construction-Only Loans finance the construction of your new home on land which you already own. Again, the borrower is required to apply for a permanent mortgage loan once construction is complete. -

Future Proofing

Make sure to design for your future, not for your current needs. Add value to your home by keeping the future in mind. By building a space you can grow in, will save you money in the end.

Whether you follow through with building your home, or settle on improving or buying an existing home, contact our lending experts to help you with your homeownership journey. We’re always ready to help you with all of your endless possibilities.