The First-Time Homebuyer Savings Account Act will provide state income tax deductions to individuals who utilize a savings account dedicated to storing funds specifically for a first home. Any Missouri resident or married couple can open an account at any Missouri bank and designate it for their future first home.

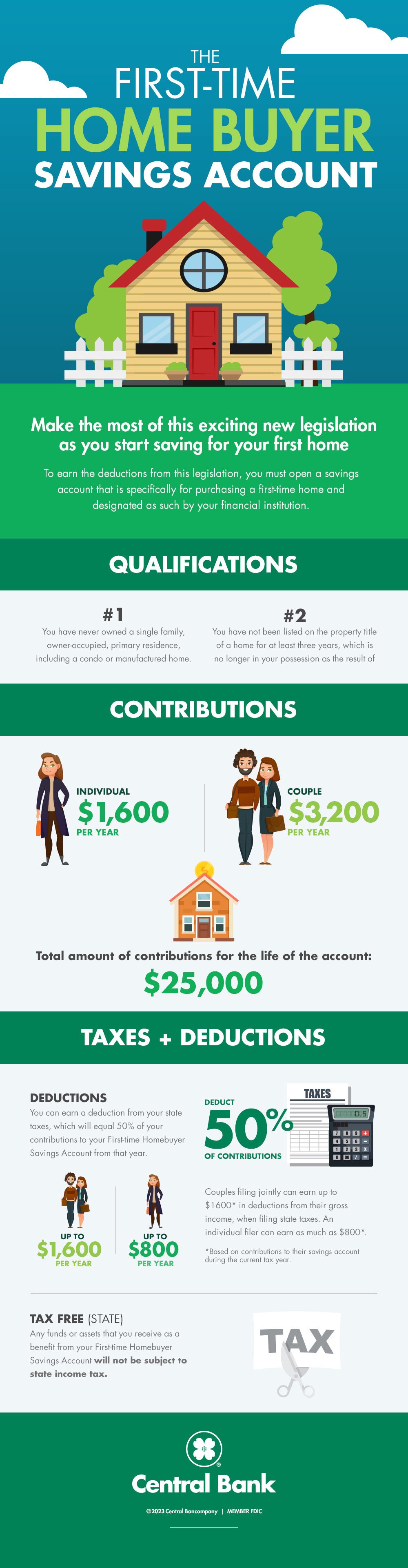

To earn the deductions from this legislation, you must open a savings account that is specifically for purchasing a first-time home and designated as such by your financial institution.

Use this guide to the First-time Homebuyer Savings Account Act to ensure you make the most of this legislation as you start saving to buy your first home!

What are the qualifications?

- You have never owned a single family, owner-occupied, primary residence, including a condo or manufactured home.

- You have not been listed on the property title of a home for at least three years, which is no longer in your possession.

What contributions can you make?

- As an individual, you can contribute $1,600 per year to this account.

- As a couple, you can contribute $3,200 per year into this account.

- The total amount of contributions for the life of the account is $25,000.

What Taxes and Deductions will you receive?

- Deductions

You can earn a deduction from your state taxes, which will equal 50% of your contributions to your First-Time Homebuyer Savings Account from that year. This means that as an individual you can earn up to $800 per year and as a couple you can earn up to $1,600 per year in deductions from your gross income. - Tax Free (State)

Any funds or assets that you receive as a benefit from your First-Time Homebuyer Savings Account will not be subject to state income tax.

Stop by any Central Bank location to open your First-Time Homebuyer Savings Account or open your account online!