During unexpected hardships, you may find yourself unable to complete your car payments. Paying off car loans may seem like a challenge, but there are steps you can take to prevent unwanted outcomes, like car repossession. If you find yourself unable to make car payments, here is a guide to help you navigate these stressful times.

-

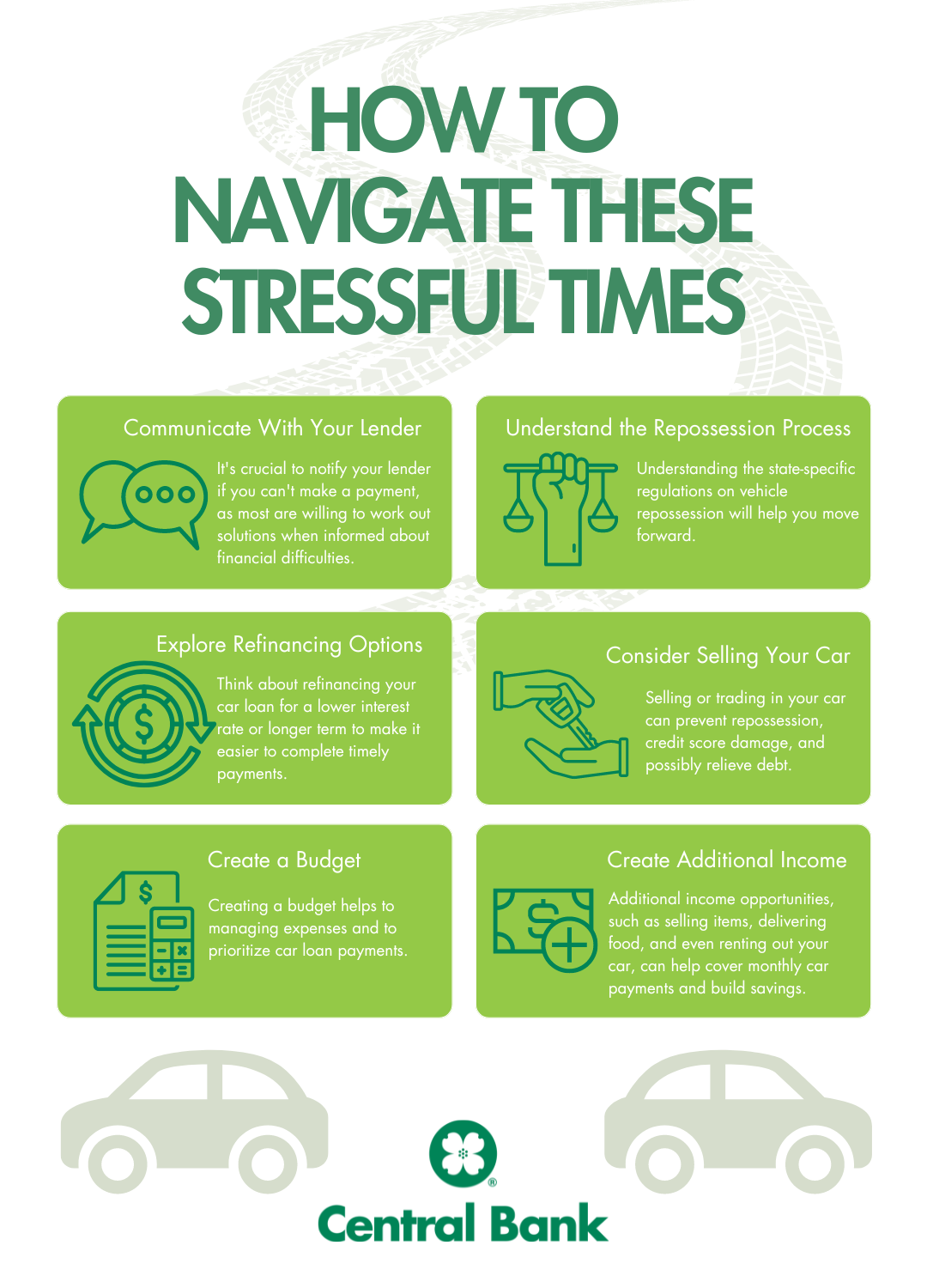

Communicate With Your Lender

When you know you're unable to make a payment, it's important to inform your lender about the situation. Failure to communicate could result in car repossession. Fortunately, most lenders are willing to collaborate on solutions, such as creating a payment plan. By openly communicating your financial difficulties with your lender, you may discover they provide options such as loan deferrals or waivers for late fees. -

Know What the Repossession Process Looks Like

Each state has different rules regarding vehicle repossession. Check your state’s rules to understand what this process looks like and steps to take afterward. In many states a lender may take your car as soon as you default on the loan or fail to make payments as set according to the agreement. Your contract will explain what actions will put you in default; however missing a car payment once is a common reason.

Once your car gets repossessed, the lender must send you a Notice of Repossession and Intent to Sell. This notice will specify whether the sale will be public or private. If it is a public sale, it must include the date and time, allowing you or a designated representative to attend and bid on the vehicle, protecting your interest. However, you are still responsible for the full amount of the original loan. If you purchase the vehicle for less than what is owed, you will still have a deficient balance owed to the lender. -

Explore Refinancing Options

If a lower interest rate or a longer term car loan could enable you to complete car payments on time, it’s worth considering refinancing. Understand that while this may help you now, it could end up costing you more over time. For example, a $40,000 car loan with an 84 month term, and six percent interest rate, could end up costing you around $9,000 in finance charges. If you decide to refinance your car loan, make sure it's at a credible company, with agreements thoroughly explained to you. -

Consider Selling Your Car

If you’re facing ongoing difficulties with making car payments, selling or trading in your car is a step in the right direction to avoid repossession or significant damage to your credit score. By selling your car you could pay off the remaining debt. Trading in is a good option if you still need transportation but want something more manageable to pay off. -

Create a Budget

Creating the right budget can make paying off your car loans easier. A budget helps you control spending, meet financial goals, and plan out how to meet payments. Start by making a list of all bills and expenses, and allow a portion of your income to cover your car payment. Track your monthly expenses, and identify non essential items to prioritize the cost of your average car payment. Regularly reviewing your budget ensures you are in control of your money and can make timely payments. -

Find Ways to Make Additional Income

Adding additional income to compliment your monthly salary may be the right option for you to make your monthly car payments. This can even help you build up your savings in case of a future unexpected life event, and further ensure that you can continue to make your car payments. Some ways to make money on the side could be selling clothes you no longer wear, delivering food for local restaurants or companies like Uber Eats and Postmates, renting out an unused room in your house, offering services in babysitting or pet sitting, or renting out your car!

Missing car payments can lead to repossession, negative impacts to your credit score, and extra fees. Consider all of these factors when you miss a payment or know you are going to. Moving forward, know that there are options and you are not alone in this process. Around six percent of people struggle to make their car payment, meaning there are people and programs who understand your struggles and are here to help.