Investing can be a daunting task, especially when there is a multitude of investment strategies. It's crucial to find one that aligns with your goals and preferences. One such approach is thematic investing, an increasingly popular strategy that focuses on investing in trends or themes.

What is Thematic Investing?

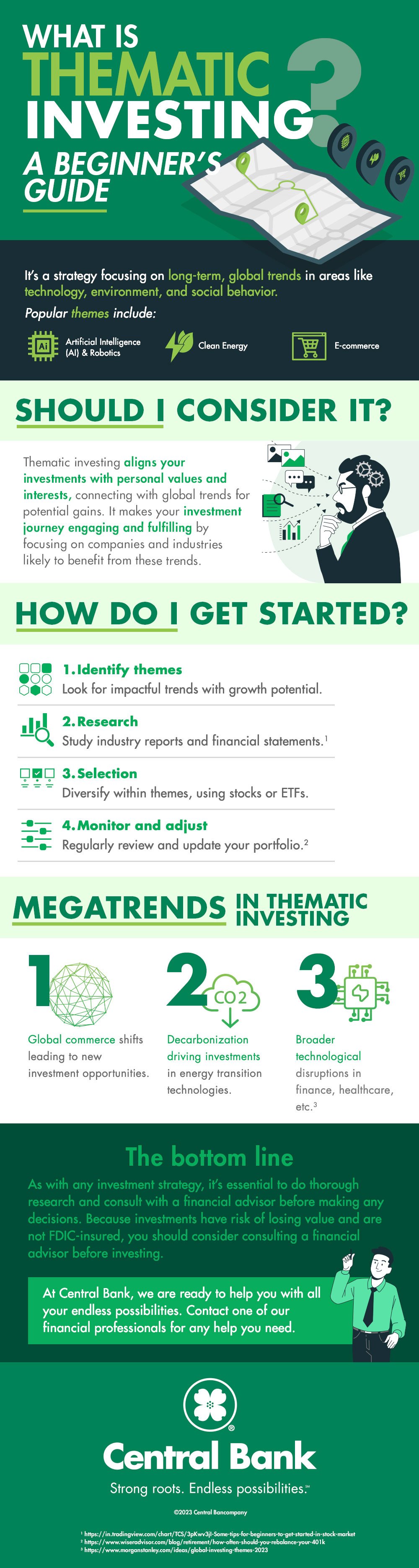

Thematic investing is a forward-looking approach that involves identifying and investing in long-term, global trends or themes. These themes typically represent major shifts in demographics, technology, environment, or social behavior.

Examples of Popular Themes:

- Artificial Intelligence (AI) and Robotics

With advancements in technology, AI and robotics are transforming industries and creating new market opportunities. This theme focuses on companies involved in AI research, development, and implementation, as well as those producing or utilizing robotics. - Clean Energy

As global awareness of climate change increases, clean energy solutions such as solar, wind, and hydroelectric power are gaining momentum. This theme encompasses companies that produce or support clean energy technologies, as well as those that make efforts to reduce their carbon footprint. - E-commerce

The rapid growth of online shopping is reshaping the retail industry. Investing in e-commerce means focusing on companies that operate or support online marketplaces, payment systems, and logistics services.

What are the Objectives of Thematic Investing?

The main goal of thematic investing is to capitalize on these changes by investing in the companies or industries that stand to benefit the most from these trends.

Thematic investing allows you to invest in companies or industries that align with your personal values or interests. This can make your investment experience more rewarding and engaging.

How Do I Get Started with Thematic Investing?

- Identify themes

Start by identifying themes that you believe will have a significant impact on the global economy in the coming years. Consider factors such as market size, growth potential, and the competitive landscape. - Research

Conduct thorough research on the industries and companies within your chosen themes. This can include reading industry reports, analyzing financial statements, and staying updated on industry news. - Selection

Invest in a diverse set of companies within each theme to minimize risk. This can be achieved by investing in individual stocks or through exchange-traded funds (ETFs) that focus on specific themes. - Monitor and adjust

Regularly review your investments to ensure they still align with your chosen themes and goals. Be prepared to adjust your portfolio if market conditions or your investment goals change.

Thematic investing is a unique and forward-looking approach that allows you to potentially capitalize on emerging trends while aligning your investments with your personal values. By identifying long-term themes and investing in the companies or industries that stand to benefit the most from these trends, you can enjoy greater diversification in your investment portfolio. As with any investment strategy, it's essential to do thorough research. Because investments have risk of losing value and are not FDIC-insured, you should consider consulting a financial advisor before investing.