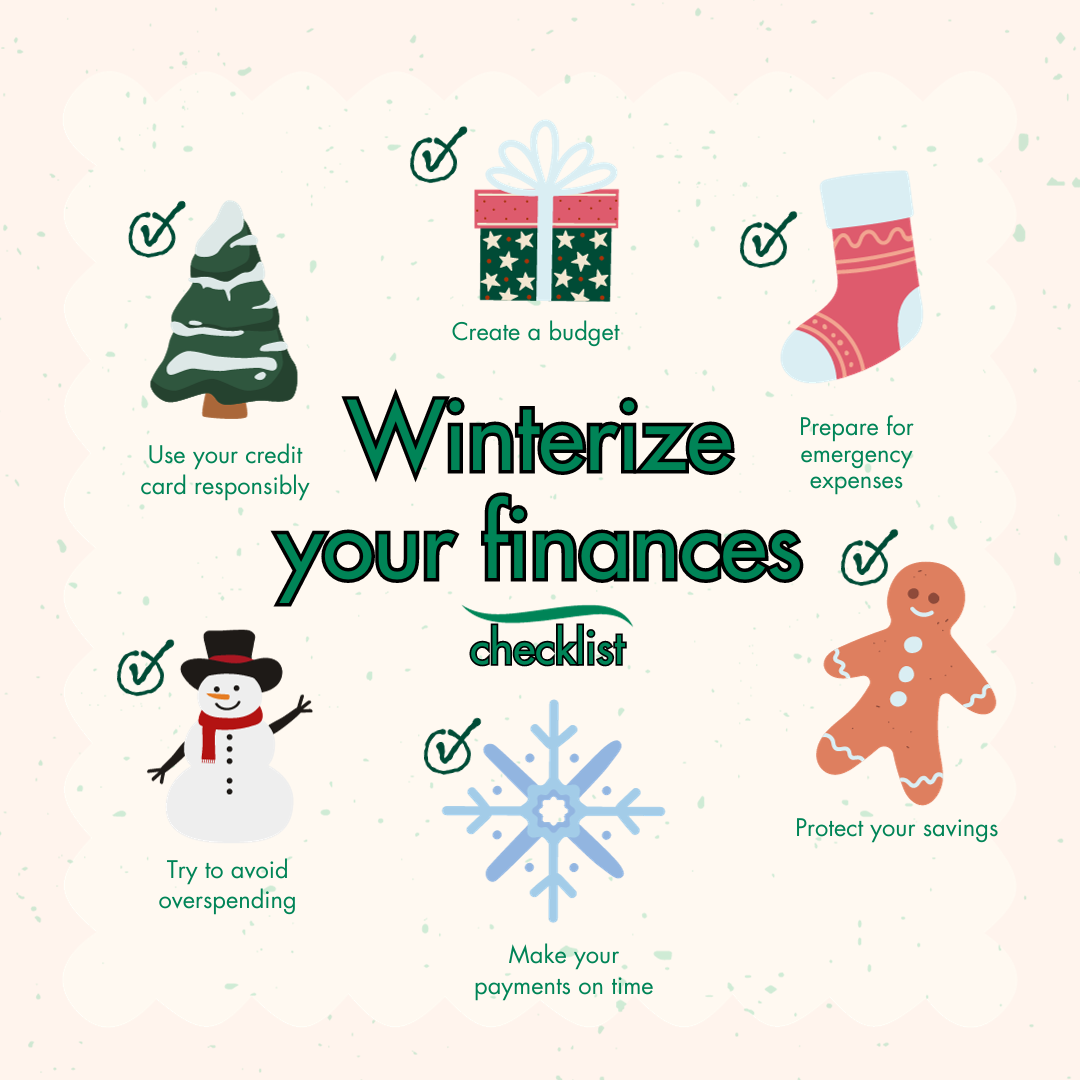

Winter is the time for festive celebrations, cozy fires, and crisp weather. But it can also bring financial challenges with increased bills from heating to holiday shopping. It is important to be prepared for changes in spending so that you can avoid potential debt. A tool that can be helpful with this is an automated budget through your credit card. Learn how this tool can keep you from making mistakes during big spending times.

-

Pick the automated budget that's best for you

An automated budget, like Money Manager, makes it easy for you to create a personalized budget and link it to your accounts, including your credit cards. You can set alerts, track your spending progress, and view all your accounts in one spot. You can also categorize transactions into categories and monitor bills and income. There are several different options so see which automated budget best aligns with your savings goals. -

Create a budget

Before winter arrives, it's important to create a budget. Credit cards can be a helpful tool to track expenses within your automated budget. Begin with estimating your usual budget then adjust for your new increase in expenses such as heating, gifts, travel, and extra groceries. You can also take advantage of budgeting calculators to help you from over spending. -

Use a credit card over a debit card

Using a credit card during big spending times can lead to future rewards that debit cards do not have. With credit cards you can build up rewards with every purchase. You can use these rewards to get cash back, buy merchandise, and pay your bills. Rewards can be extremely helpful if you save them for big spending times or emergencies. -

Think about emergency expenses

Winter can bring surprises like icy roads and burst pipes. Having an emergency credit card or an emergency section of your budget can be a great safety net. Using an emergency card can help protect your savings because you can pay it off on your own time with the minimum payment option or cash back from rewards. -

Make your payments on time

In order to protect your credit score make sure to make your payments on time even when expenses are higher. Late payments can lead to unwanted fees, rates, and penalties that can throw off your budget. If you have emergency expenses making the minimum payment is better than paying late.

While automated budgets can be helpful during big spending times like the holidays, make sure to stick to them and avoid over spending. Try to not buy too many gifts and decorations and leave room for emergency expenses. By planning ahead and using an automated budget you can enjoy the winter season without added financial stress.