Credit Card Rules to Live By

It is important to know how to use a credit card wisely so that you don’t fall into traps that could lead to debt.

Credit cards are extremely convenient, allowing you to buy now and then pay later. With a credit card you can borrow money up to your limit and then pay it back every month or over time. But understanding credit cards is necessary when you are sticking to a budget and building your credit history. Your credit card has the potential to turn messy and be a danger to your financial health if you make common mistakes. Learn how to avoid mistakes and use your card like a pro.

-

Pay your balance every month

Credit card balances should be paid on or before the due date. Paying the balance in full has great benefits. If you wait to pay the balance or only make the minimum payment it accrues interest. If you let this continue it can potentially get out of hand and lead to debt. Missing a payment can not only accrue interest but hurt your credit score. -

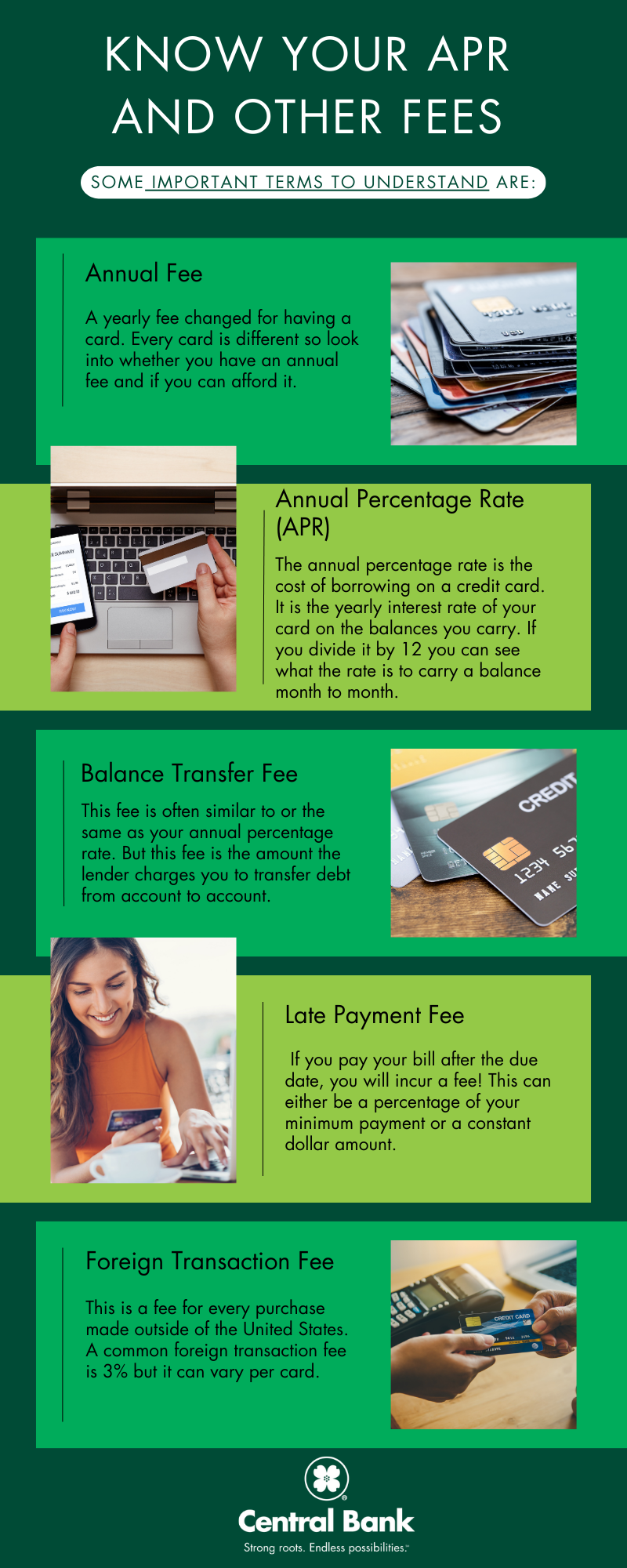

Know your APR and other fees

Some important terms to understand are:

Every card is different so make sure to read the fine print, so your fees don’t start to add up. -

Build a solid credit history

If you’re new to the credit card world, getting a card with a low limit or a secured card is smart. Then you can start paying the balance in full and on time every month. This is a great way to establish credit. Using a credit card responsibly can help build you a solid credit history whether you’re a new or experienced card user. This can prepare you for an apartment, a loan, and many other future events. -

Incorporate your credit card into your budget

Understanding how to use credit cards is a wise part of budgeting and they can be very helpful if you use them correctly. If you need help creating a budget, you can use a budget calculator. This helps tailor your budget to your monthly income and expenses. With a good understanding of your budget, you can better manage your spending and credit card payments. -

Spend mindfully

Credit cards make it easier for us to make purchases but unfortunately they also make it easier for us to overspend. Focusing your purchases on necessities can go a long way in helping you stay on budget. If you can, schedule out major purchases and plan how you will pay them off. Prioritizing your needs and budget can help you avoid potential debt and keep you with a solid credit history. -

Understand your rewards

Rewards are a great factor to consider when choosing a credit card and understanding them can help you save money. You can use credit card points to book trips, get cash back, and even buy tickets for events. Every credit card offers a variety of rewards, so it is important to get one that matches with your spending and saving goals.

If you learn how to use credit cards wisely and understand your budget, you can avoid mistakes that lead to debt and reach your goals sooner than you think!