Making the choice to buy a home is quickly followed by an abundance of other decisions you will have to carry out, like where the house will be located and what you want in your perfect new home. One of the most important decisions you'll need to make is what type of mortgage works best for you.

This choice is crucial because it will affect your finances for the next few years, if not decades, of your life. There are so many options that first-time homebuyers, or even experienced homebuyers, might feel overwhelmed with the decision.

However, once you understand the pros and cons of the various mortgage options, this decision will be easier for you.

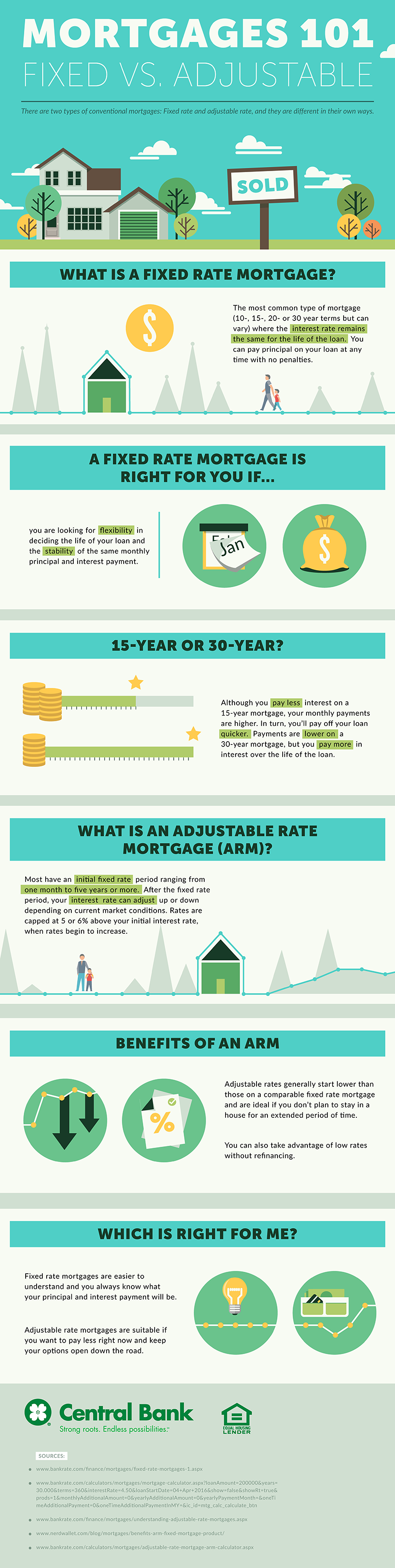

First, all homebuyers should know there are two different types of mortgages that are the most common: fixed-rate and adjustable-rate mortgages.

Fixed or adjustable?

The interest rate in a fixed-rate mortgage (FRM) stays the same throughout the entire life of the loan, whether it is 10 years or 30. A fixed-rate mortgage is best for people who are looking for flexibility in deciding the life of your loan and the stability of the same monthly principal and interest payment.

On the other hand, an adjustable-rate mortgage (ARM) will keep the same rate for a short period of time at the beginning of the loan, then adjust yearly based on current market conditions. This means it could go up or down, but it's not easy to predict which way it will go, or by how much. It's important to note there is a cap on how much the rate can change. This cap is generally five to six percent above your initial interest rate. FRMs are best for people who want a predictable monthly payment. This can help with budgeting for the long-term without worrying about potential interest rate changes in the future.

ARMs also have their benefits. Typically, the first few years of an ARM have a lower interest rate than an FRM, so this type of loan is good for people who want to save more money now, but are financially confident in their future. They are also a great option for people who plan to sell their home before the initial fixed term is over.

When deciding which mortgage option is right for you, it's important to think about your current and future finances. Everyone's situation and lifestyle is different, so what is right for one new homeowner won't be right for everyone. It's a good idea to speak with a mortgage lender to learn about how your finances will be affected by a mortgage before making a concrete decision.