Sending and receiving money with your phone through mobile payment apps is handy. But be careful! Scammers might try to trick you into sending them money instead. Here's what you need to know about using these apps safely.

How Mobile Payment Apps Work

You are probably familiar with Venmo, PayPal, Cash App, and Zelle. First, you download the app and make an account. Then, you link up your bank account, debit card, or credit card. After that, you can start sending and receiving money. But hold up – the money doesn't go straight to your bank. It stays in the app until you decide what to do with it. So, how can scammers get your money?

How Scammers Trick You

- Pretending to be Someone You Know

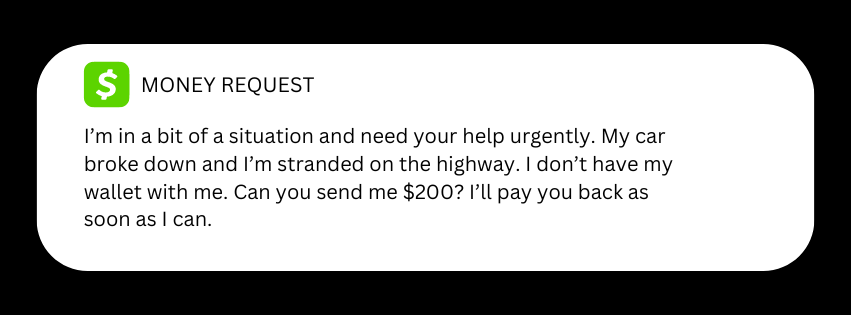

Sometimes, scammers pretend to be a family member or friend in trouble, asking for money urgently to deal with an emergency. For example, they might create a fake payment app profile, using your family member’s name. When they request you to send them money, it could say “’I'm in a bit of a situation and need your help urgently. My car broke down and I’m stranded on the highway. I don’t have my wallet with me. Can you send me $200? I’ll pay you back as soon as I can.”

Tip: If someone you know asks for money unexpectedly, check with them directly to make sure it's really them. Make sure to always double-check the recipient's information before hitting send. - Claiming You Won a Prize

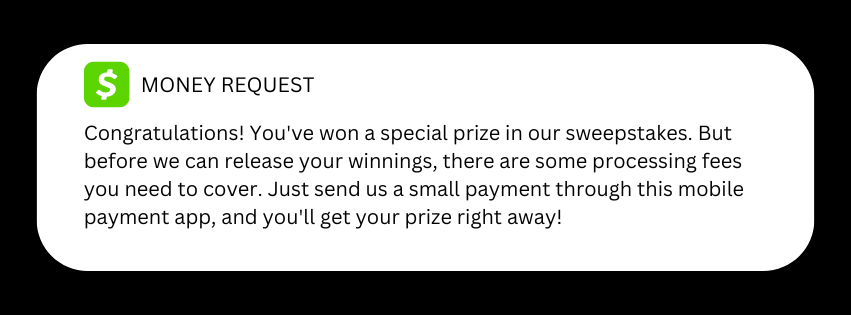

Scammers might claim you've won a prize but need to pay fees to collect it. When the scammer contacts you, they might say "Congratulations! You've won a special prize in our sweepstakes. But before we can release your winnings, there are some processing fees you need to cover. Just send us a small payment through this mobile payment app, and you'll get your prize right away!"

Tip: Don't fall for claims that you won a prize or need to pay to collect winnings. - Pretending to be Your Bank

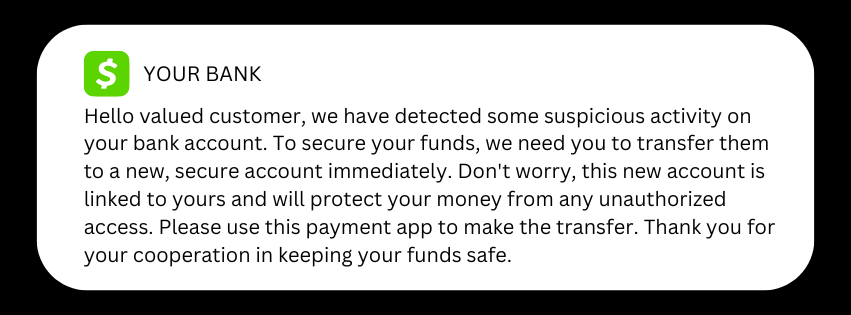

Scammers also might pretend to be your bank, saying there's an issue with your account. Scammers might say something like “Hello valued customer, we have detected some suspicious activity on your bank account. To secure your funds, we need you to transfer them to a new, secure account immediately. Don't worry, this new account is linked to yours and will protect your money from any unauthorized access. Please use this payment app to make the transfer. Thank you for your cooperation in keeping your funds safe.”

Tip: Remember, your bank won't ask you to transfer money or share personal information over the phone.

What if You've Been Scammed?

If you suspect you've fallen victim to a scam, report it to the payment app, your financial institution, and then to the FTC at ReportFraud.ftc.gov. By speaking up, you're helping stop scammers in their tracks!