A great choice whether you're a student looking to start your financial journey, or want an account for daily use. Easily manage your account online with the tools built for you.

$5 or $0 monthly fee disclosure 4

Go above and beyond your typical checking account! Enjoy extra security, resources, and savings to help you maximize your money. disclosure 5

$9.95 monthly fee

Receive first-rate customer service, access to exclusive services, and a premium rate on your account.

$20 or $0 monthly fee disclosure 6

Flexible banking, competitive interest rates, and convenience all with one account.

$10 or $0 monthly fee disclosure 7

With innovative tools like the Home Screen Widget – quickly access cards, transfers, mobile check deposit, and Zelle®³ – you can manage your new checking account even easier!

It’s all about creating the best banking experience for you! From our service standards, to the technology and tools (that we use, too!), see for yourself what it means to bank better! You’ll be happy you did.

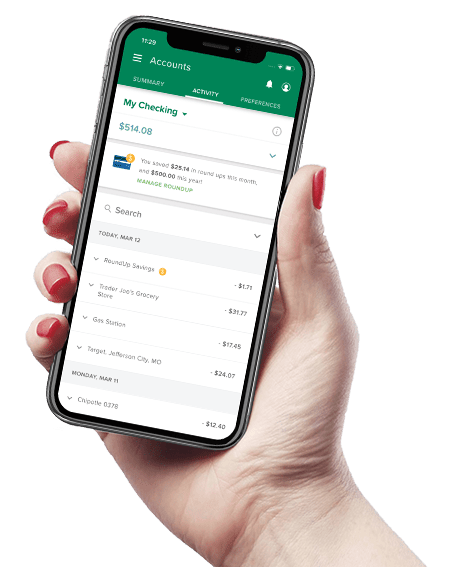

Access your account from anywhere, anytime, and stay on top of your finances while enjoying your favorite activities with the Central Bank Mobile App!²

Whatever you’re doing, it’s convenient and flexible to stay up to date on your account from anywhere.

Download the Central Bank Mobile App using the below links.

Apple App Store

Google Store

Misplaced your credit or debit card? Prevent new purchases with your card just by toggling the switch "off" within Online Banking or the Mobile Banking App. Ready to unlock? Toggle the switch "on" to allow all transactions.

Safely and conveniently deposit checks from anywhere!

Never miss a beat with your account – be alerted about account balances, deposits, transactions, card activity, and more!

Use Zelledisclosure 3 to send money to friends and family right from Online and Mobile Banking! It's fast, safe, and easy.

Access your banking statements and tax documents online anytime, for up to seven years!

Automatically tracks and categorizes spending to help you create a personalized budget and set savings goals!

We're excited to serve the Colorado area and want to meet you! Together, let's take your banking to the next level. Come say hi and visit and location near you.

You can also waive your monthly maintenance fee by maintaining $25,000.00 average daily balance in all deposit accounts with the same primary account holder (Checking, Savings, Money Market, or Certificate of Deposit) for the statement cycle.

The average daily balance is calculated by adding the principal in the account for each day of the period and dividing that figure by the number of days in the period. Back to content

Credit Score is a VantageScore 3.0 based on single credit bureau data. Third parties may use a different type of credit score to assess your creditworthiness. Once you have activated credit file monitoring, you may request your credit score. Once you have done so, you will have access to your score on a monthly basis.

Additional terms, conditions and exclusions apply and are subject to change.

Special Program Notes: The descriptions herein are summaries only and do not include all terms, conditions and exclusions of the Benefits described. Please refer to the actual Guide to Benefit and/or insurance documents for complete details of coverage and exclusions. Coverage is provided through the company named in the Guide to Benefit or on the certificate of insurance. Insurance Products are not insured by the FDIC or any Federal Government Agency. Not a deposit of or guaranteed by the bank or any bank affiliate.

Available via mobile or web only.

You will have access to your credit report and core provided your information has been verified by the CR Back to content

World Checking: To avoid the monthly fee:

The average daily balance is calculated by adding the principal in the account for each day of the period and dividing that figure by the number of days in the period.

Paper statements are available for a fee of $3.00 per statement cycle. Back to content

This card is issued by The Central Trust Bank pursuant to a license by Mastercard International Incorporated. Mastercard is a registered trademark of Mastercard International Incorporated. Subject to credit approval.

Zelle is intended for sending money to family, friends and people you are familiar with. We recommend that you not use Zelle to send money to anyone you don’t know. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC, and are used herein under license.