Bank with the Best and get $300disclosure 1!

Central Bank continues to be recognized as one of "America's Best Banks" by Forbes magazine year after year. If you're ready to bank with the best, get started with $300disclosure 1 when you open any eligible checking account. Member FDIC.

Promo Code: COMMUNITYROOTS

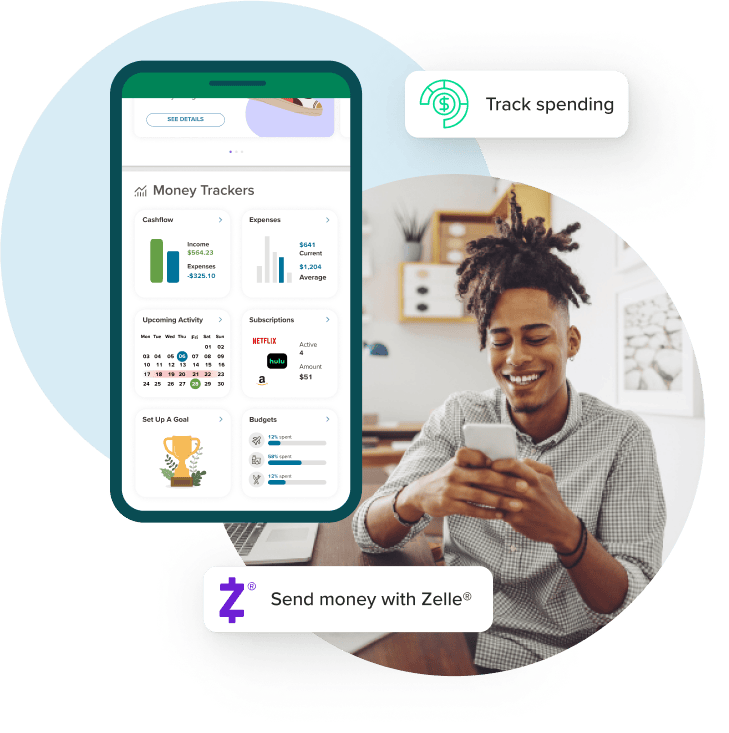

Access Popular Features Even Faster!

With innovative tools like the Home Screen Widget – quickly access cards, transfers, mobile check deposit, and Zelle®³ – you can manage your new checking account even easier!

It’s all about creating the best banking experience for you! From our service standards, to the technology and tools (that we use, too!), see for yourself what it means to bank better! You’ll be happy you did.

MyChoice Checking

A great choice whether you're a student looking to start your financial journey, or want an account for daily use. Easily manage your account online with the tools built for you.

$5 or $0 monthly fee disclosure 4

MaxMoney Checking

Go above and beyond your typical checking account! Enjoy extra security, resources, and savings to help you maximize your money. disclosure 5

$9.95 monthly fee

World Checking

Receive first-rate customer service, access to exclusive services, and a premium rate on your account.

$20 or $0 monthly fee disclosure 6

Preferred Interest Checking

Flexible banking, competitive interest rates, and convenience all with one account.

$10 or $0 monthly fee disclosure 7

Services you Need, Technology you Expect

We get it, you need a bank that helps you make your life easier.

- Flexible Account Options: Choose from a range of checking accounts that align with your lifestyle, whether you’re a student, a busy professional, or enjoying retirement.

- Fee Transparency: No hidden fees—just straightforward terms so you know exactly what to expect.

- More Than 30,000 ATMs Nationwide: No matter where you go, conveniently access fee-free ATMs through the MoneyPass network.

- Custom Mobile App: Access your account anytime, anywhere. Check balances, transfer funds, pay bills, and deposit checks – built in-house just for you!

- Greenlight: Central Bank customers enjoy a free subscription to Greenlight, the money and safety app built with families in mind, and designed for kids of all ages.

Get Personal with Your Finances

The Mobile App, Built for You

We designed this app with you in mind! Manage your account – view activity, make transfers, deposit checks, send Money with Zelle®disclosure 3, lock your card, and more!

4.8

Google Store

4.9

Apple App Store

Experience Over 120 Years of Banking Excellence

Stop by any branch location and say “hi!” – we’re ready to help serve your financial needs!

Whether it’s your everyday banking needs, or helping you build for the long-term, don't miss out on this opportunity to take your banking to the next level.

-

To receive the $300 checking bonus, open and maintain any personal checking account except Free Checking. Deposit $50 or more at account opening; and have at least two or more direct deposits with a cumulative total of $800 within 90 days of account opening. Minimum balance of $50.00 required 90 days after account opening to receive bonus. Qualifying types of Direct Deposits include any direct deposit from Payroll, Pension or Government Benefit. Bonuses are reported to the IRS as interest. Bonuses will be deposited into the checking account within 15 business days after account(s) 1) meets all requirements AND 2) has been open for 90 days. Available to new checking account customers only. Offer is not available to those whose accounts have been closed with a negative balance within the last 2 years. You will receive only one new checking account opening related bonus every two years from the last date incentive was paid. Only one bonus per household. Customer must bring in mailer or use offer code to receive incentive. Offer may only be redeemed by the intended recipient and is nontransferable. Eligibility for this offer will be verified prior to providing the bonus. The new checking account must be open and in good standing on the date any earned bonus is paid. We reserve the right not to open accounts for customers outside our market area. Please contact us for further details. Checking account promotion ends 12/31/2025. Back to content

-

Mobile carrier data and text rates may apply. Back to content

-

Activation/Registration required. Back to content

-

MyChoice Checking: To avoid the monthly fee - you must receive electronic statements and one of the following:

- Maintain a minimum daily balance of $2500.00 per statement cycle; or

- Maintain a recurring cumulative direct deposit of $500.00 per statement cycle; or

- Use your debit card at least 20 times for a point of sale (POS) transaction (transaction only counts if it has posted to the account during the monthly cycle; or

- The primary account holder is under the age of 25.

- Requirements to avoid the monthly maintenance fee will be effective the statement cycle following the primary account holder’s 25th birthday.

You can also waive your monthly maintenance fee by maintaining $25,000.00 average daily balance in all deposit accounts with the same primary account holder (Checking, Savings, Money Market, or Certificate of Deposit) for the statement cycle.

The average daily balance is calculated by adding the principal in the account for each day of the period and dividing that figure by the number of days in the period. Back to content

-

MaxMoney Checking: Must submit the other bank’s ATM receipts to any teller or customer service representative within 60 days of a transaction. ATM refund will be limited to $10 per receipt with a maximum of $25 per statement cycle.

Credit Score is a VantageScore 3.0 based on single credit bureau data. Third parties may use a different type of credit score to assess your creditworthiness. Once you have activated credit file monitoring, you may request your credit score. Once you have done so, you will have access to your score on a monthly basis.

Additional terms, conditions and exclusions apply and are subject to change.

Special Program Notes: The descriptions herein are summaries only and do not include all terms, conditions and exclusions of the Benefits described. Please refer to the actual Guide to Benefit and/or insurance documents for complete details of coverage and exclusions. Coverage is provided through the company named in the Guide to Benefit or on the certificate of insurance. Insurance Products are not insured by the FDIC or any Federal Government Agency. Not a deposit of or guaranteed by the bank or any bank affiliate.

Available via mobile or web only.

You will have access to your credit report and core provided your information has been verified by the CR Back to content

-

World Checking: To avoid the monthly fee:

- Maintain an average daily balance of $15,000 each monthly statement cycle. The average daily balance is calculated by adding the principal in the account for each day of the period and dividing that figure by

the number of days in the period; or - Maintain an average daily balance of $250,000 or greater in all deposit accounts with the same primary account holder (Checking, Savings, Money Market or Certificate of Deposit) for the statement cycle. The average daily balance is calculated by adding the principal in the account for each day of the period and dividing that figure by the number of days in the period; or

- Central Trust Company Client; or

- Maintain a balance of $250,000 in a Central Investment Advisors Brokerage Account.

- Maintain an average daily balance of $15,000 each monthly statement cycle. The average daily balance is calculated by adding the principal in the account for each day of the period and dividing that figure by

-

Preferred Interest Checking: To avoid the monthly fee - you must have a daily balance of $5,000.00 for the monthly statement cycle; or,

Maintain $25,000.00 average daily balance in all deposit accounts withe the same primary account holder for the statement cycle (Checking, Savings, Money Market, or Certificate of Deposit).The average daily balance is calculated by adding the principal in the account for each day of the period and dividing that figure by the number of days in the period.

Paper statements are available for a fee of $3.00 per statement cycle. Back to content

This card is issued by The Central Trust Bank pursuant to a license by Mastercard® International Incorporated. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. Subject to credit approval.

Zelle is intended for sending money to family, friends and people you are familiar with. We recommend that you not use Zelle to send money to anyone you don’t know. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC, and are used herein under license.