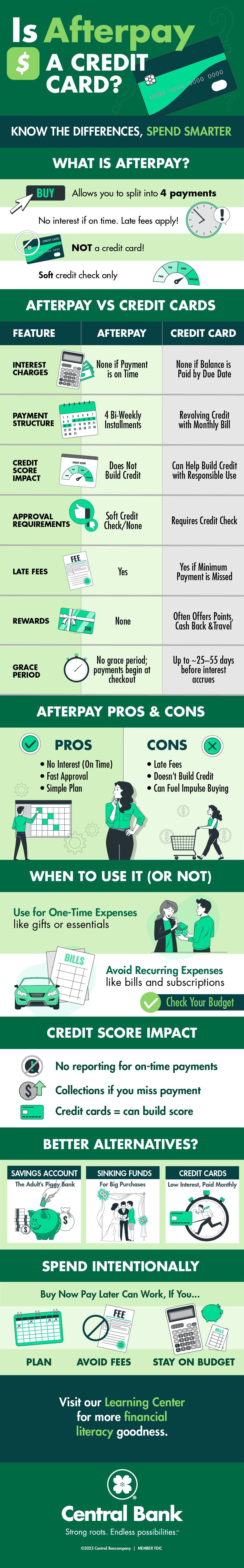

What Is Afterpay?

Afterpay is a buy now, pay later (BNPL) service that allows you to split purchases into four equal payments, paid every two weeks. You can use it online or in-store at participating retailers, often with just a few taps. As long as you make each payment on time, you won’t pay interest—though late fees may apply.

Afterpay is not a credit card, even though it may seem like a simplified version of one. It doesn't affect your credit score with frequent use or provide a revolving credit line. With no hard credit check at the time of application and a fixed spending cap that changes over time depending on your repayment history, it works more like a short-term installment loan.

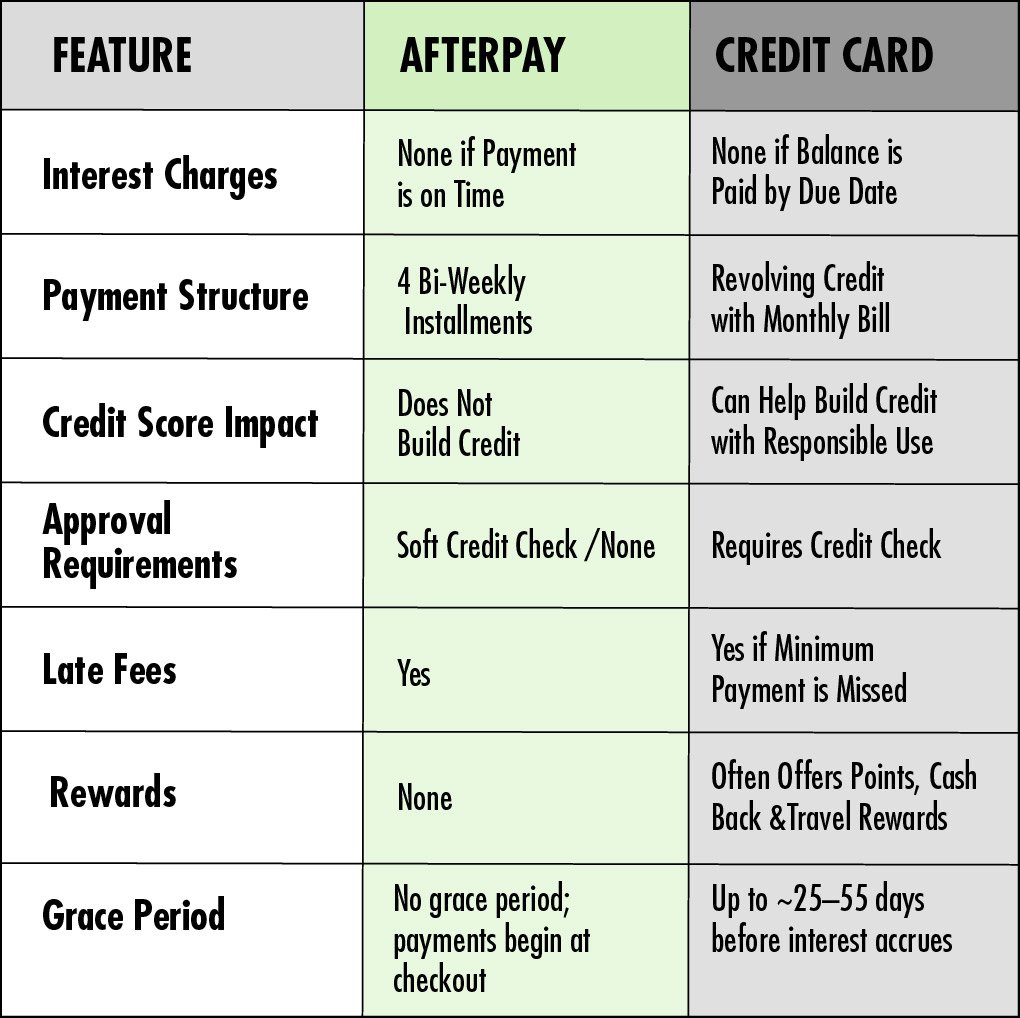

Key Differences Between Afterpay and Credit Cards

It's easy to see how Afterpay differs from a conventional credit card by contrasting the two:

Using either option without a plan can lead to overspending. Setting clear limits and tracking your payments can help you stay in control and avoid unnecessary debt.

Pros and Cons of Afterpay

Like any payment tool, Afterpay has its upsides and downsides. It can make purchases more manageable in the short term, but it also comes with potential risks. Understanding both the benefits and drawbacks can help you decide if it fits your financial habits.

Pros:

- No interest if you pay on time

- Fast and easy approval

- Fixed, predictable repayment schedule

Cons:

- Late fees can add up quickly

- Doesn’t help you build credit

- May encourage impulse buying

Before using Afterpay—or any BNPL option—it’s worth checking in on your financial habits. Practicing good financial habits can help you avoid turning short-term tools into long-term trouble.

When to Use Afterpay (and When Not To)

Afterpay can work well for one-time expenses like gifts, clothing, or replacing essentials when you’re in a pinch. It becomes riskier when used to bridge gaps between paychecks or to fund ongoing expenses.

If you’re frequently turning to BNPL to cover basic costs, it may be time to revisit your budgeting plan.

Does Afterpay Affect Your Credit Score?

Afterpay doesn’t report on-time payments to credit bureaus, which means it won’t help you build a strong credit history. On the flip side, if you miss payments and fall behind significantly, your account could be sent to collections, which can harm your credit down the line.

By contrast, credit cards can be used strategically to improve your credit score if you keep your balances low and make consistent, on-time payments. To better understand how your credit score is calculated, explore Understanding Credit Scores.

Are There Better Options?

In many cases, the best alternative to either Afterpay or a credit card is simply saving up for your purchase. A savings account can act as your own personal BNPL system, without fees or interest.

Other safe options:

- Sinking funds for larger, planned purchases

- Low-interest credit cards – offer flexibility and, when paid in full each month, can provide an interest-free grace period plus the benefit of earning rewards.

Buy now, pay later services like Afterpay can be useful—but only when used intentionally and within a budget. Unlike a credit card, Afterpay won’t help you build credit, and missed payments could lead to fees or collections.

Before choosing how to pay, consider your long-term financial goals and use the tools available in the Central Bank Learning Center to guide your next decision.