Open a Checking Account and Get a ParkU Clip-On Speakerdisclosure 1

Open any new eligible personal checking account by December 31, 2025. Speaker may be picked up during normal business hours any time after account opening at our Parkville, MO branch. (While supplies last.)

Promo Code: PARKSTUDENT

)

Real Stories. Real Reasons to Switch.

Free Features with Every Account:

Pay with Zelle

Use Zelle® to send money to friends and family right from Online and Mobile Banking! It's fast, safe, and easy!

Deposit Checks on Your Phone

Safely, securely, and save time by depositing checks from anywhere! Using your phone's camera, just snap and submit!

Digital Wallet

Add your Central Bank Debit Mastercard® to your digital wallet for quick, secure tap-to-pay.

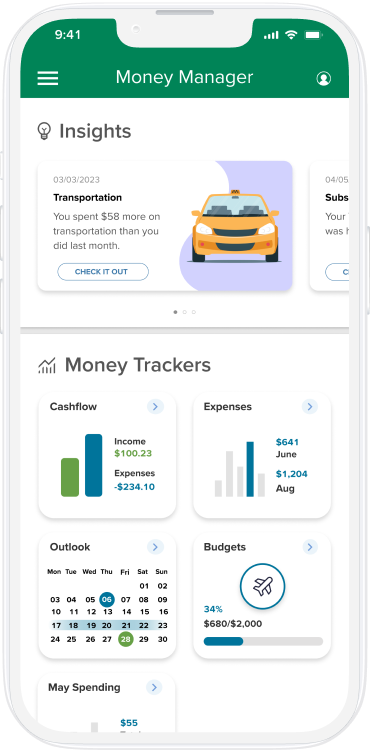

Free Budgeting Tool

Use our budgeting tool, Money Manager, to track spending, manage subscriptions, set goals, and view your finances in one place.

Get Alerted When and How You Want

Never miss a beat with your account! Stay up to date on balances, card activity, transactions, deposits, and more!

Bank on the Go

Securely and easily manage your accounts! Access features like Card Lock, eStatements and Tax Documents, enable RoundUp, and more!

Take Control of Your Finances with Our Smarter, More Personal Budgeting Tool.

Overspending is a thing of the past. Set your budget by selecting a spend category and easily visualize your progress from the Money Manager dashboard. Receive notifications when reaching milestones throughout the month.

- Keep your spending in check with budget tracking

- Organize and Track Your Transactions

- Visualize Spending to Make Better Decisions

- See All Your Money in One Place

Get Answers to Common Checking Account Questions

How do I qualify for the ParkU Speaker?

Open any new eligible personal checking account by December 31, 2025. Speaker may be picked up any time after account opening at our Parkville, MO branch. (While supplies last.)

What do I need to open a checking account online?

To open a checking account online, you'll need:

- A valid form of ID (Driver's License, State ID, or Passport)

- Your personal information (name, address, date of birth, and Social Security number)

- Your contact information (phone number and email)

- An opening deposit of at least $50

How do I set up direct deposit?

We make it simple! Just give your employer your new account number and our routing number. Click here for more details.

Can I use the mobile app to deposit checks?

Mobile Check Deposit is a free feature in the Central Bank Mobile App. Just snap a photo of the front and back of your endorsed check and deposit it securely from your smartphone or tablet anytime, anywhere. Most personal, business, cashier's, and government checks are accepted. Daily and monthly limits may apply. Deposits made before the daily cutoff on a business day are usually available the next business day.

Are there any ATM fees?

You won't pay a fee when you use a Central Bank ATM or any of the 30,000+ fee-free ATMs nationwide through the MoneyPass® network.

-

To receive a Park Pirates Clip-on Speaker, open any new eligible personal checking account. Eligible accounts include MyChoice Checking or MaxMoney® Checking. Deposit $50 or more at account opening. No minimum balance required for offer. Speaker will be given to new customer at the time of account opening, unless opened online. If opened online, the customer may pick up their speaker during normal business hours at Central Bank’s Parkville, MO branch. Park Pirates Clip-on Speakers are only available while supplies last. Limit one (1) per household. Offer is available to new checking account customers only. Customer must use offer code to receive incentive. Incentive will be reported to the IRS as interest. Offer may only be redeemed by the intended recipient and is non-transferable. Eligibility for this offer will be verified prior to providing the incentive. We reserve the right to not open accounts for customers outside our market area. Please contact us for further details. Promotion ends 12/31/2025

MyChoice Checking: To avoid the monthly fee - you must receive electronic statements and one of the following:

- The primary account holder is under the age of 25; or

- Requirements to avoid the monthly maintenance fee will be effective the statement cycle following the primary account holder’s 25th birthday.

- Maintain a minimum daily balance of $2,500.00 per statement cycle; or

- Maintain a recurring cumulative direct deposit of $500.00 per statement cycle; or

- Use your debit card at least 20 times for a point of sale (POS) transaction (transaction only counts if it has posted to the account during the monthly cycle); or

- You can also waive your monthly maintenance fee by maintaining $25,000.00 average daily balance in all deposit accounts. (Checking, Savings, Money Market, or Certificate of Deposit).

MaxMoney Checking:

- Monthly Maintenance Fee of $9.95.

- Additional terms, conditions and exclusions apply and are subject to change.

- Special Program Notes: The descriptions herein are summaries only and do not include all terms, conditions and exclusions of the Benefits described. Please refer to the actual Guide to Benefit and/or insurance documents for complete details of coverage and exclusions. Coverage is provided through the company named in the Guide to Benefit or on the certificate of insurance. Insurance Products are not insured by the FDIC or any Federal Government Agency. Not a deposit of or guaranteed by the bank or any bank affiliate.

- The primary account holder is under the age of 25; or