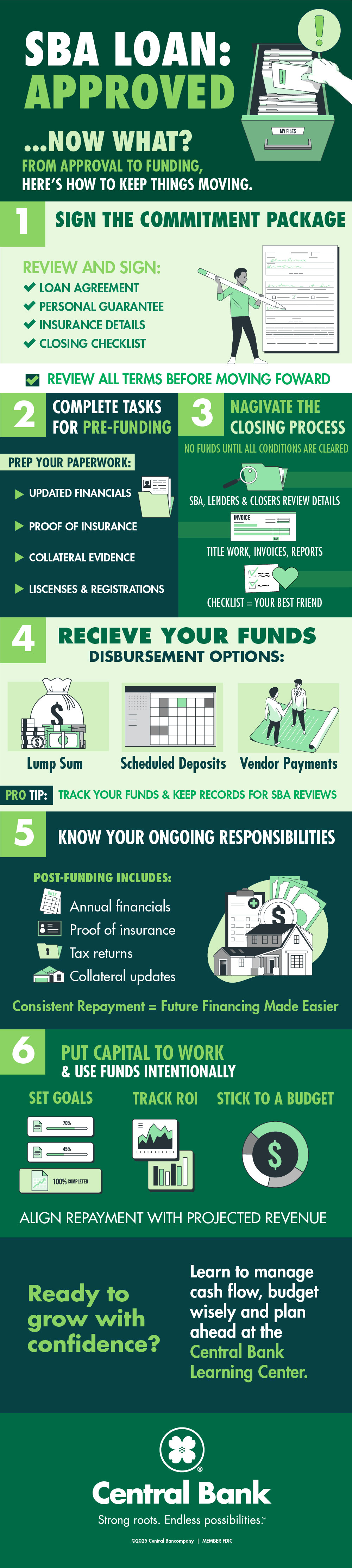

An approved SBA loan creates momentum, though several key actions still need to be completed before any funds reach your account. Staying persistent through each requirement helps you remain organized and limit delays during the closing and funding stages. This guide covers the full path from approval to disbursement, along with what a borrower should expect after receiving the lender’s commitment.

1. Review and Sign Your Commitment Package

Once approved, your lender prepares a commitment package outlining the loan terms, repayment structure, collateral requirements, and conditions that must be met before closing. This package often includes:

- Loan agreement

- Personal guarantee

- Disclosures

- Required insurance information

- A closing checklist

2. Complete Pre-Funding Requirements

Before closing, the lender verifies key details to confirm your business still meets SBA standards. This phase may request:

- Updated financial statements

- Proof of required insurance

- Evidence of collateral

- Corporate documents

- Certificates or licenses

SBA programs follow guidelines set forth in the SBA’s operating procedures. Staying organized with documents speeds up lender review and keeps the loan on track.

3. Move Through the Closing Process

Closing is the stage where your lender verifies every detail outlined in the commitment package and completes the final SBA-required checks. This step brings together several parties: your lender, the SBA, and in some cases a title company or escrow partner. Each group plays a role in confirming that the loan conditions match SBA standards and that all required documents are accurate and complete.

For real estate or construction loans, closing may involve title work, environmental reports, or verification that contractors and vendors meet SBA guidelines. Equipment purchases may require invoices, serial numbers, or vendor quotes. Working capital loans often involve a review of financials to confirm that your business remains stable between approval and closing.

Your lender typically assigns a closer who manages communication, reviews documents, answers questions, and keeps the process moving. Borrowers often receive a detailed checklist so nothing is overlooked. Any missing item can slow the timeline, which is why steady follow-through at this stage matters.

The lender confirms each condition in your commitment package — nothing moves forward until every requirement is checked off.

4. Receive Your Funds

Once closing is complete, funds are released. Depending on the structure of your loan, disbursement may occur as:

- One direct deposit

- Multiple scheduled deposits

- Vendor-specific payments (common for equipment or construction financing)

Borrowers should track deposits carefully and keep documentation for future SBA reviews.

5. Manage Post-Funding Responsibilities

After receiving funds, your business enters the repayment and monitoring stage. Lenders may check in periodically to confirm financial performance and proper use of funds. You may be asked to provide:

- Annual financial statements

- Proof of insurance

- Tax returns

- Updates on collateral

Healthy cash flow helps your business stay steady through repayment by giving you room to manage expenses, handle surprises, and keep operations moving without strain.

Consistent repayment builds a strong lending relationship and can make future financing easier.

6. Put the Capital to Work and Create a Repayment Plan

With funding in place, the focus turns to execution. Whether the loan supports expansion, equipment, working capital, or inventory, setting clear goals helps you track progress and strengthen your return on investment. A repayment plan built around projected revenue gives you a steady path forward and limits surprises.

Strong budgeting plays a central role at this stage, and projecting cash flow gives you a clearer view of how spending, revenue, and repayment will move together as your operations grow.

Ready for the Next Step?

Set your business up for long-term success by learning how to manage cash flow, build a strong budget, and prepare for future financing.

Explore more helpful guides at the Central Bank Learning Center and stay confident through every stage of your financial journey.